BFI Finance

Streamlining Business Operations Through Digital Transformation

Client

End Client

Location

BFI Finance had scaled for decades on manual processes. But with branches operating independently and field agents working without oversight, growth was hitting a ceiling.

As one of Indonesia's oldest multi-finance companies, BFI had the market presence but not the infrastructure. Every loan application involved physical paperwork, postal delays, and fragmented communication across five organisational layers.

Research

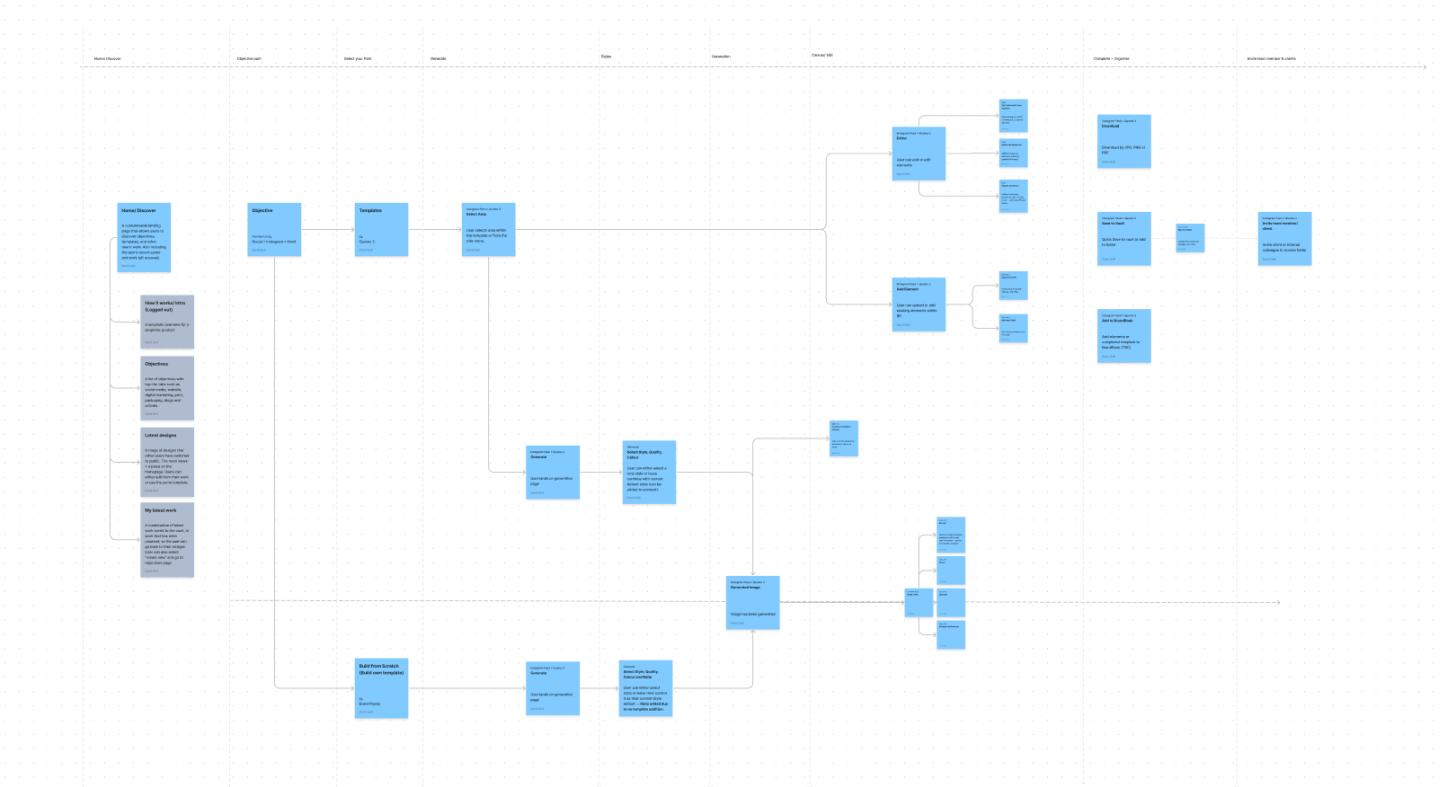

Before designing anything, we mapped the entire operation — from Head Office down to the Business Agents in the field.

The operational flow map became our foundation. It revealed how information moved (or didn't move) across five layers: Head Office, Branch Managers, Supervisors, Agency Relationship Executives (AREs), and Business Agents (BAs).

The flow map illustrates BFI's complete organisational structure — from Head Office down to Business Agents in the field. It revealed how information moved (or didn't move) across five layers, where manual processes were causing delays, and where digital tools could have immediate impact.

What I Designed

Three distinct products, each solving a specific operational gap identified in research.

These aren't standalone tools — they form a connected ecosystem. Applications submitted through the Secured Loan platform flow directly to Business Agents and AREs through their field tools.

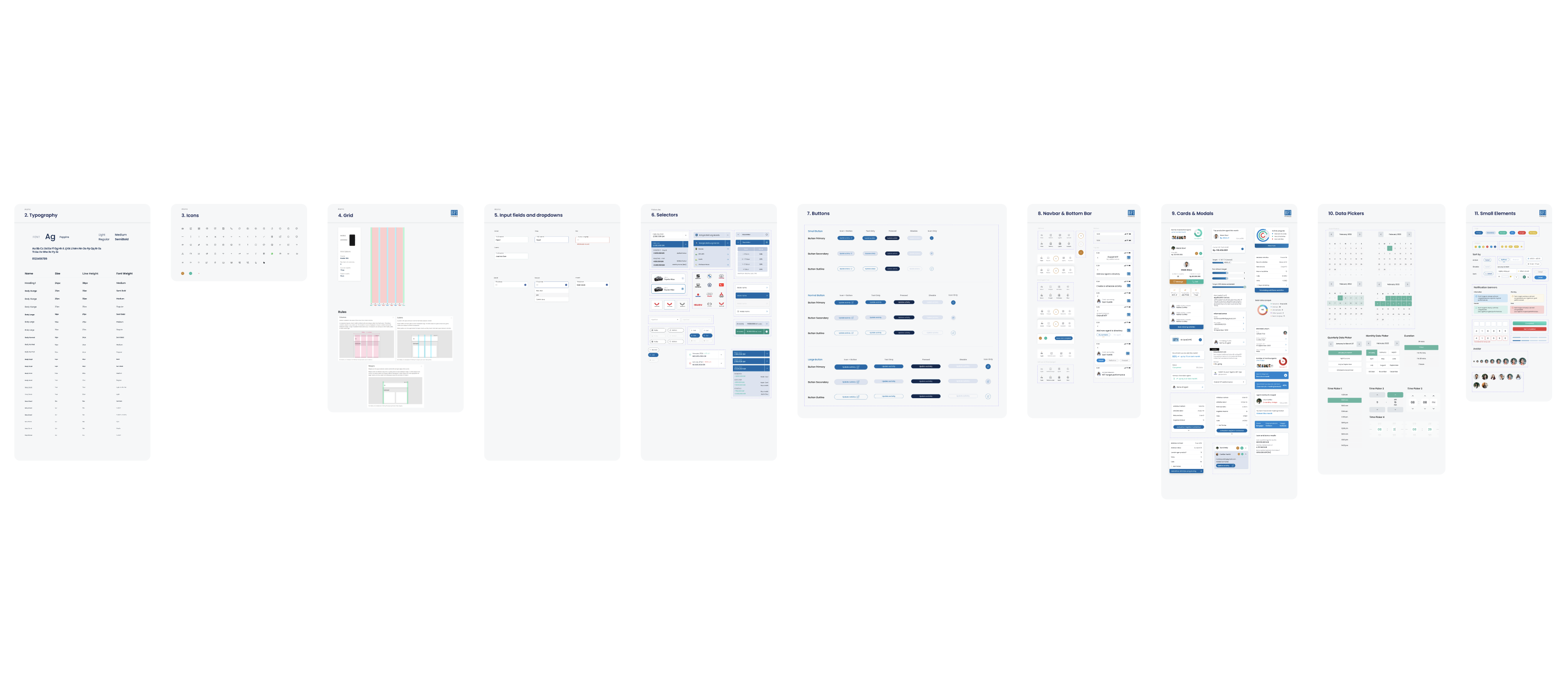

Atomic Design Approach

Recognising the project's scale, I established an atomic design system from day one.

Components built for the Secured Loan Application were reused across the ARE and BA tools — by the time we reached the Merchant platform, 80% of the UI was already built.

The atomic design system breaks down the interface into atoms, molecules, organisms, and templates — ensuring consistency across all three products while enabling rapid iteration. Each component was designed once, documented thoroughly, and deployed everywhere.

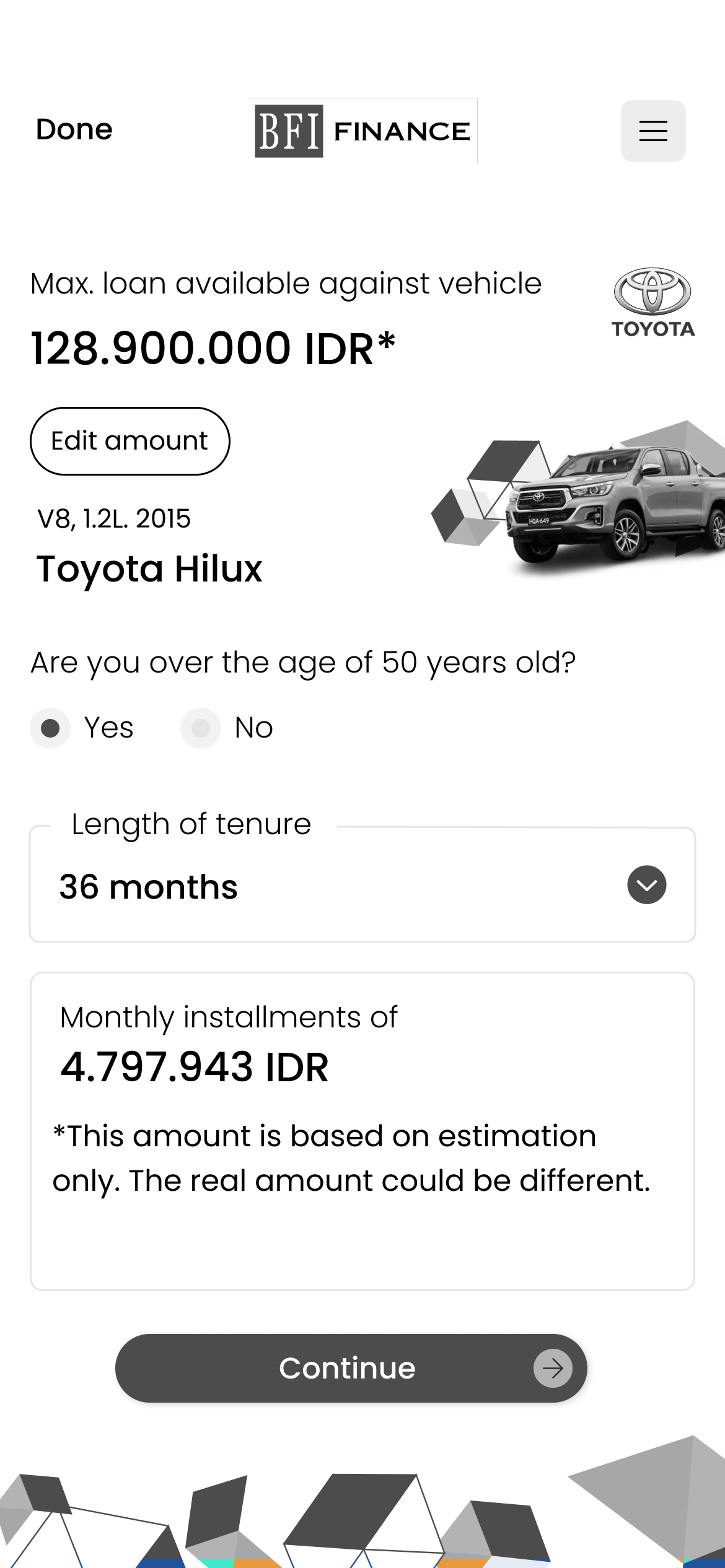

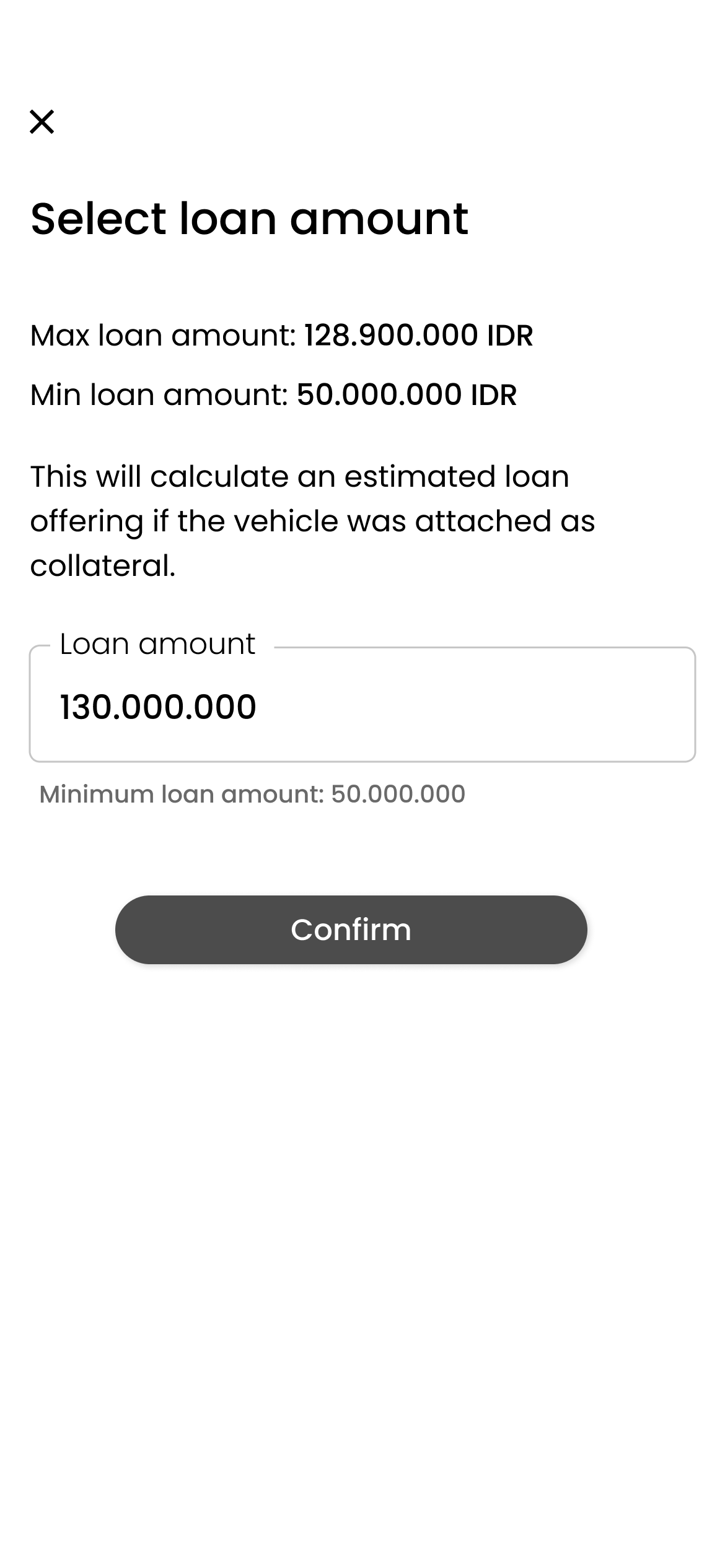

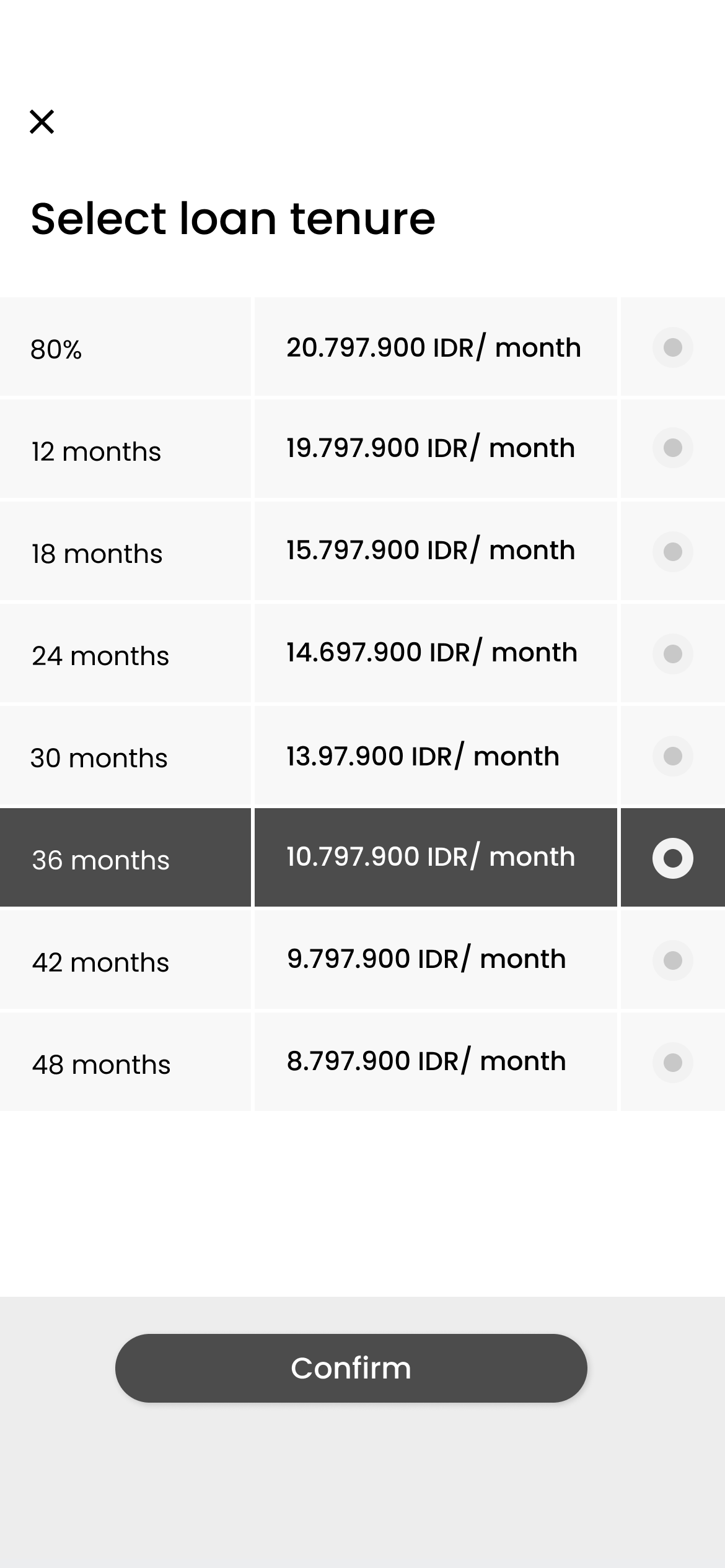

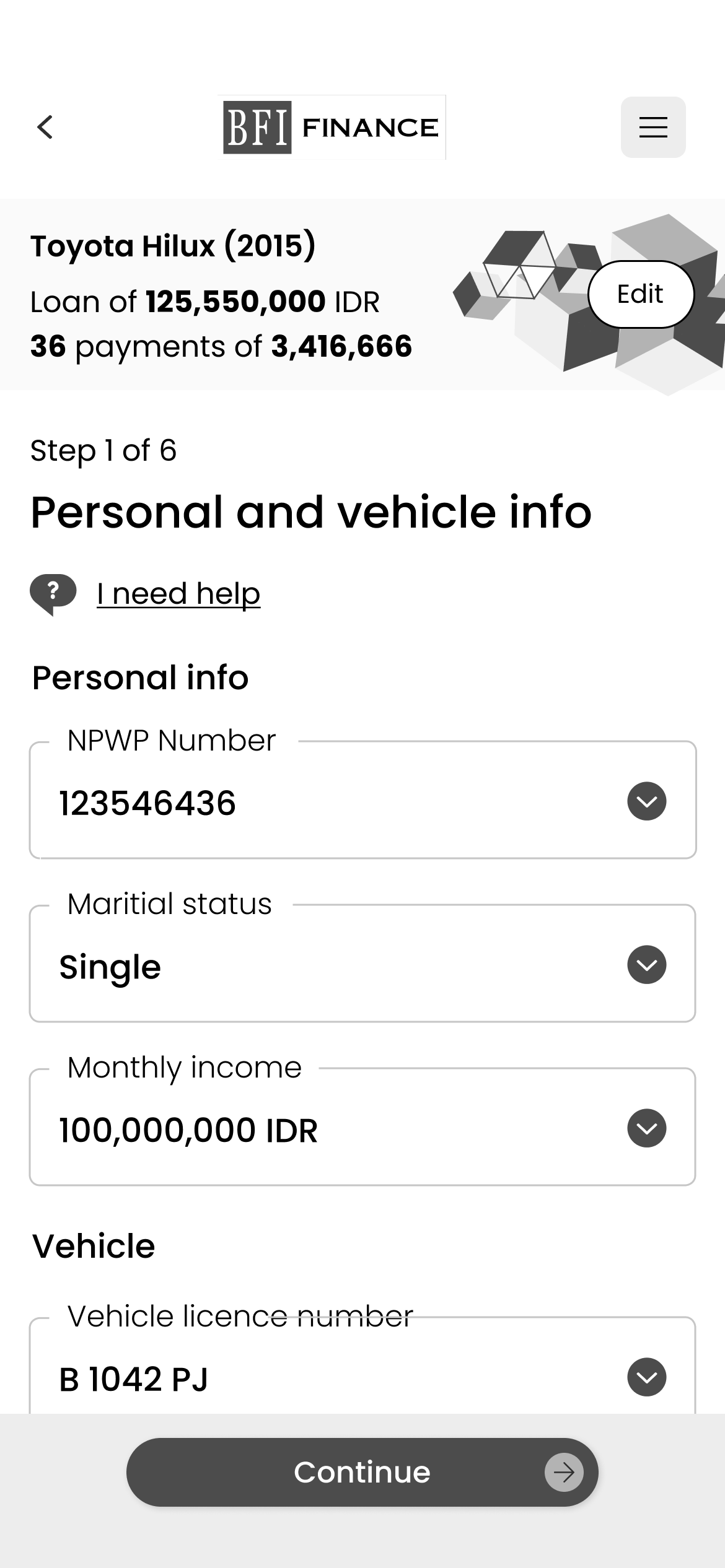

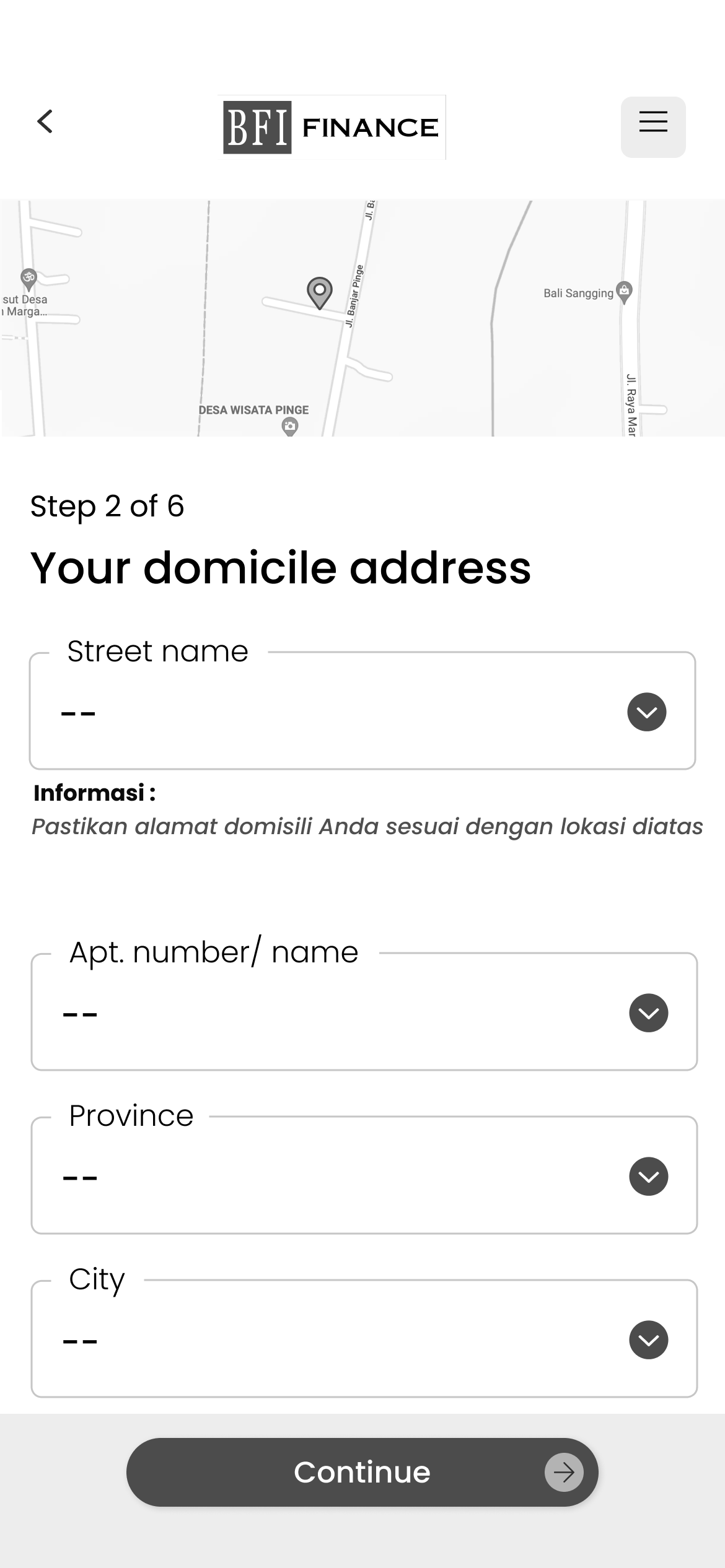

Secured Loan Application

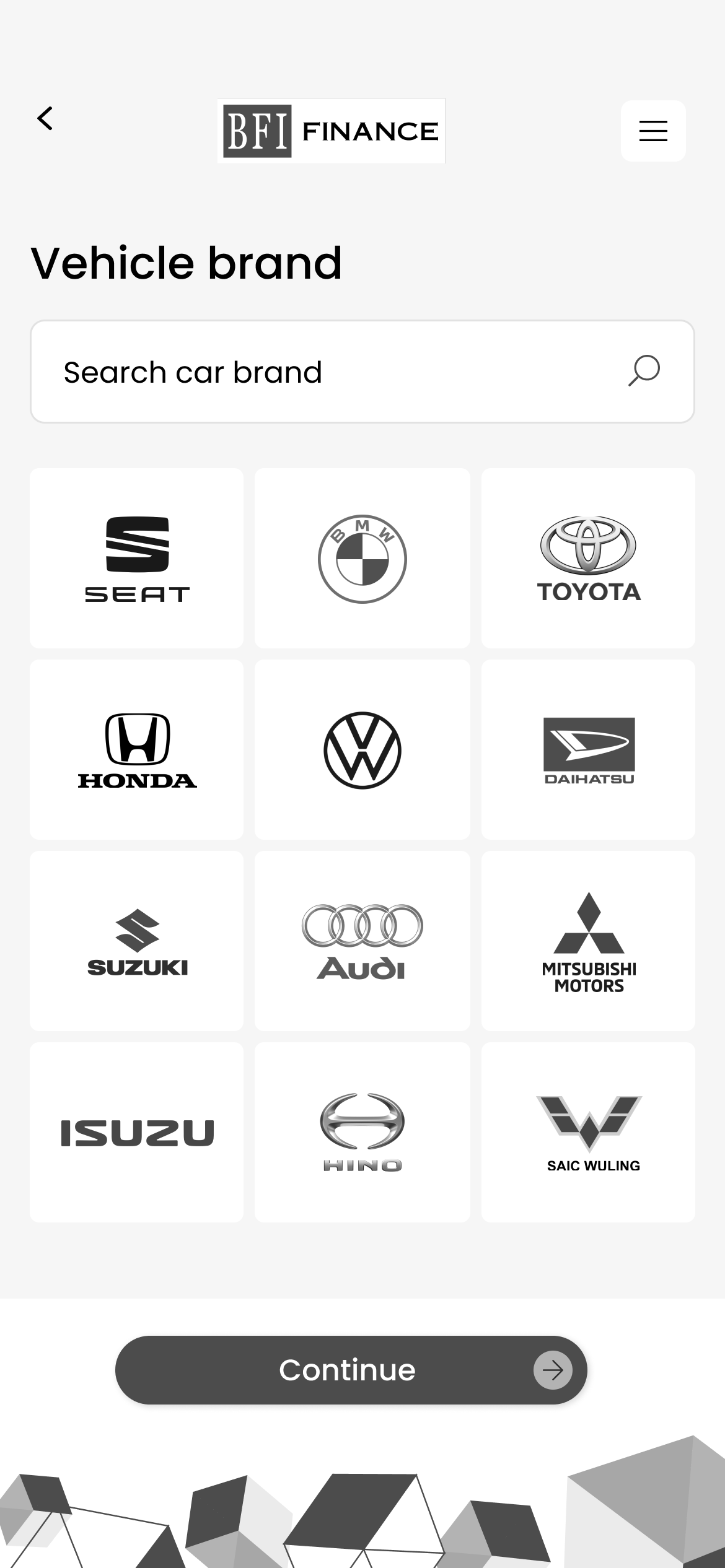

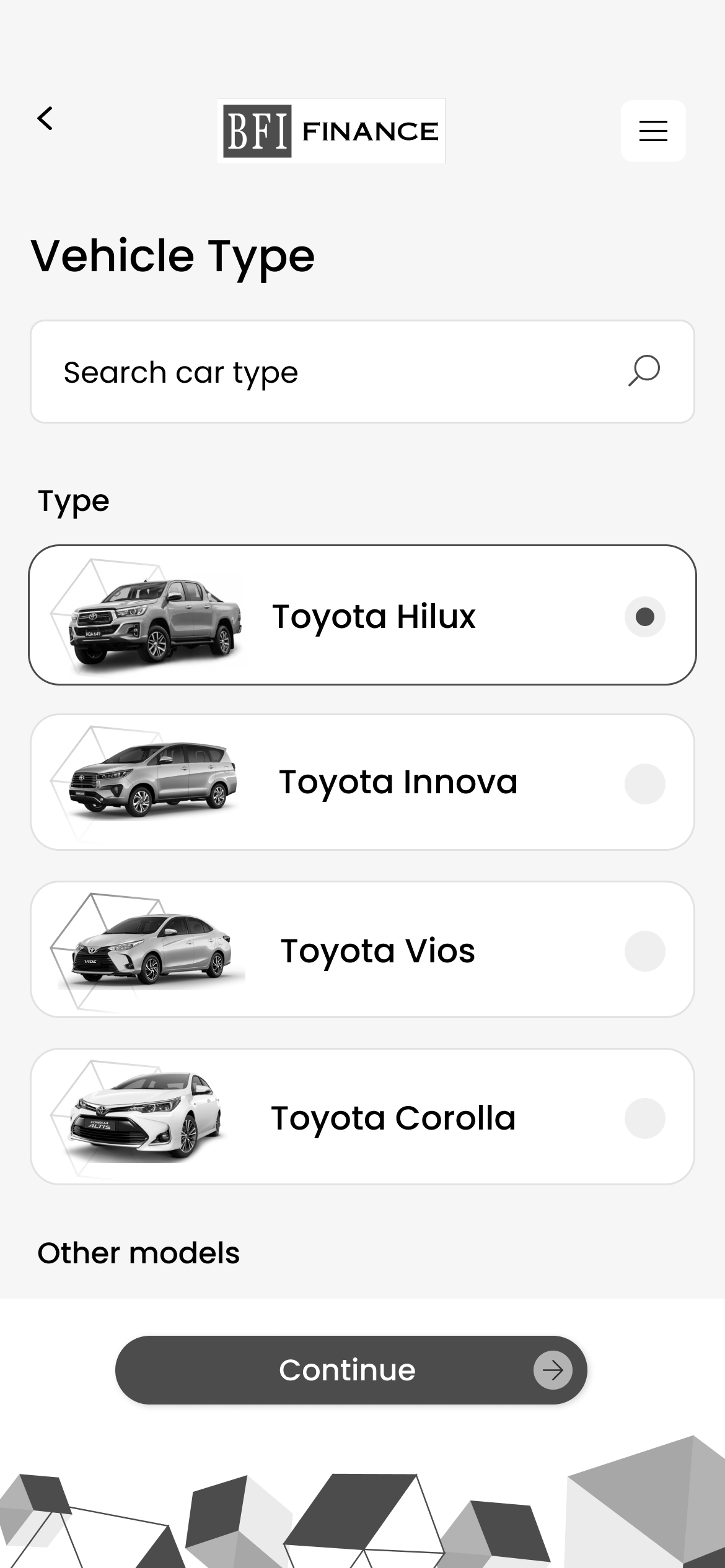

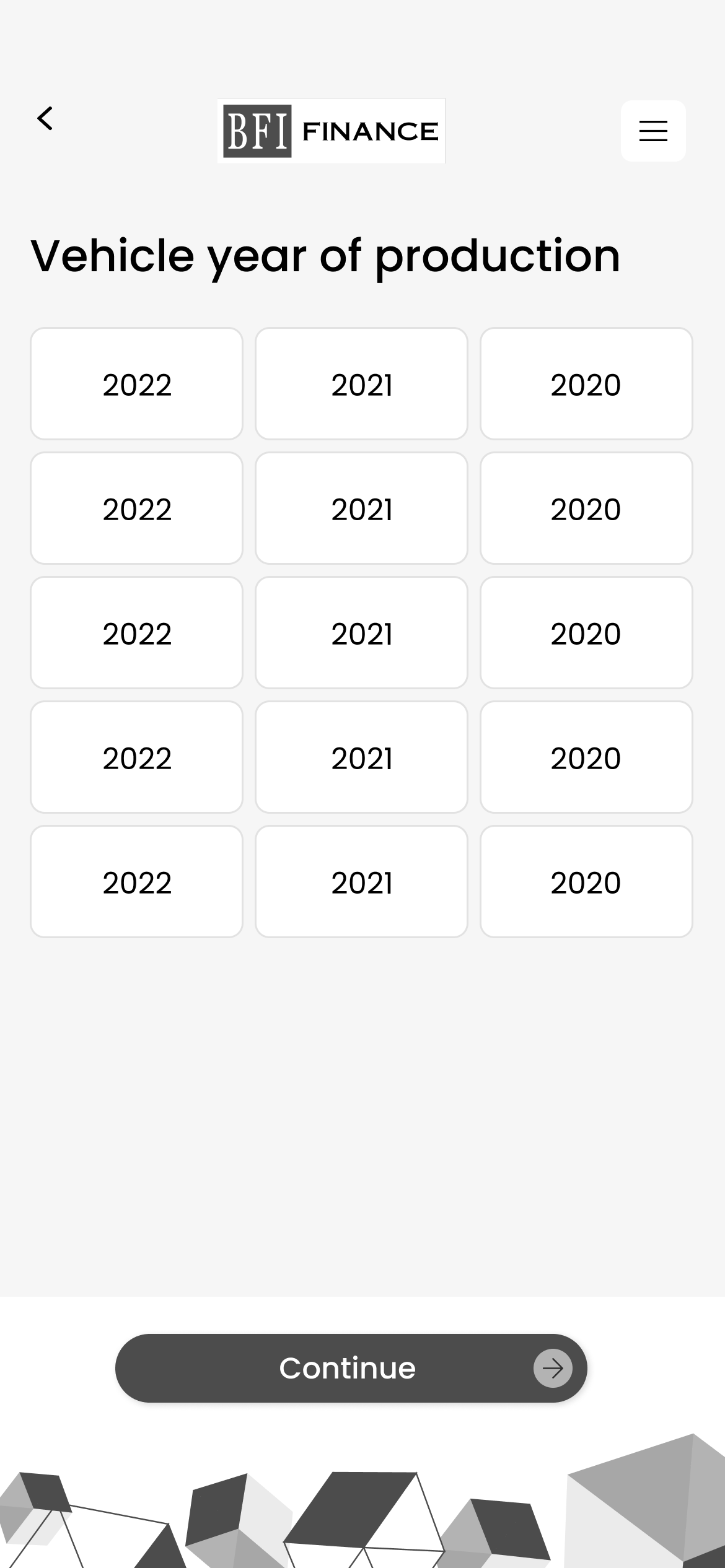

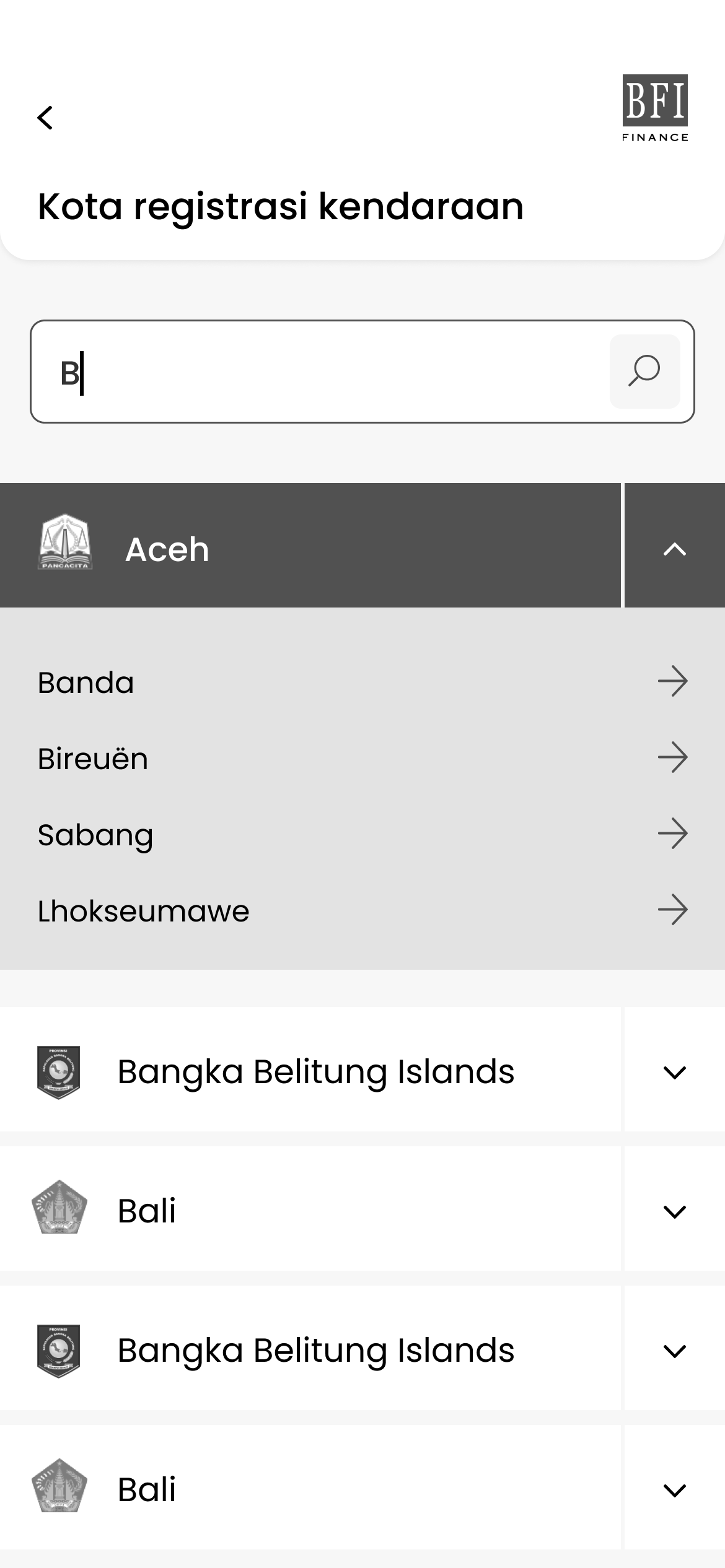

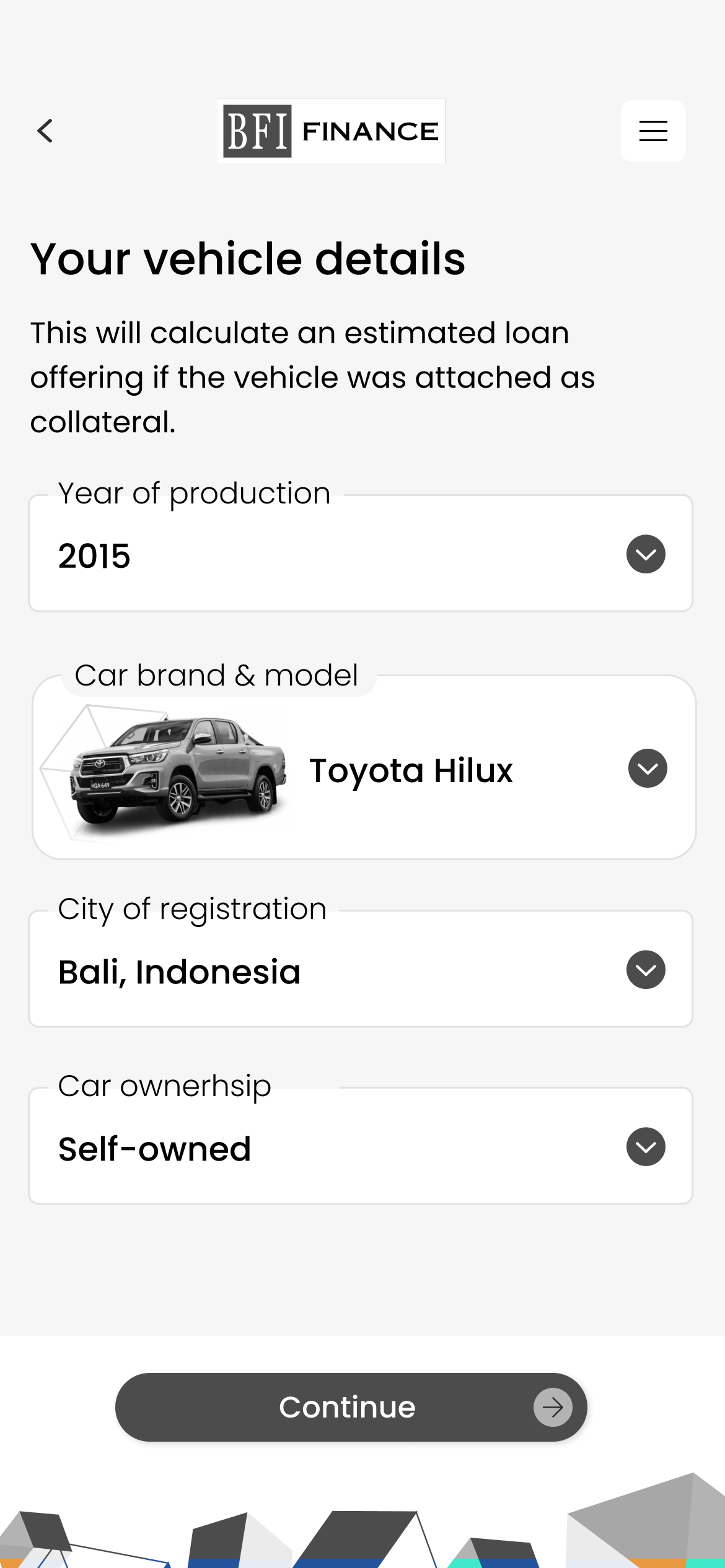

The old process was slow, manual, and full of friction. We rebuilt it for speed.

Previously, loan applications required physical paperwork, postal back-and-forth, and weeks of waiting. We designed a self-service experience where customers complete applications independently — in minutes, not weeks.

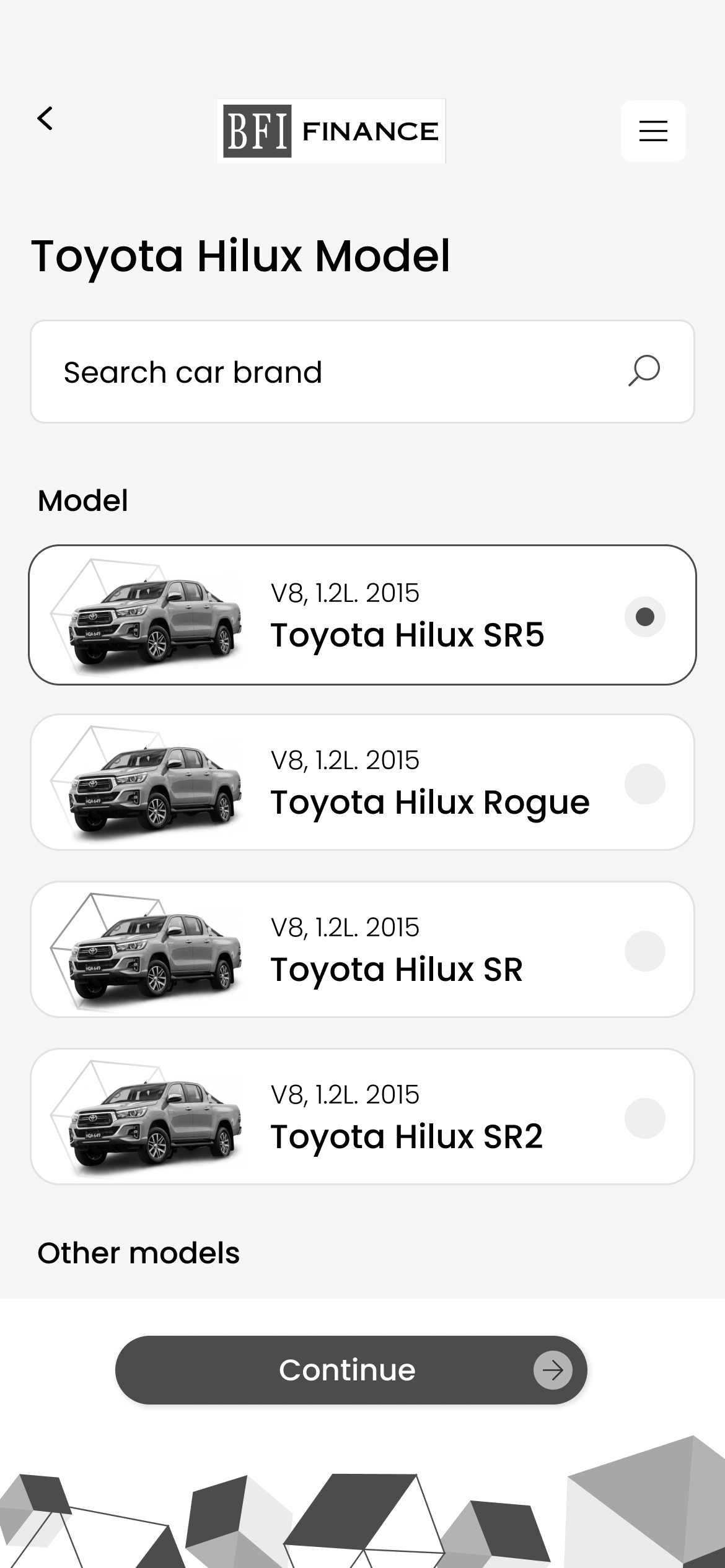

Vehicle Brand Selection

Image-based brand selection makes vehicle identification fast and intuitive

Field Agent Tools

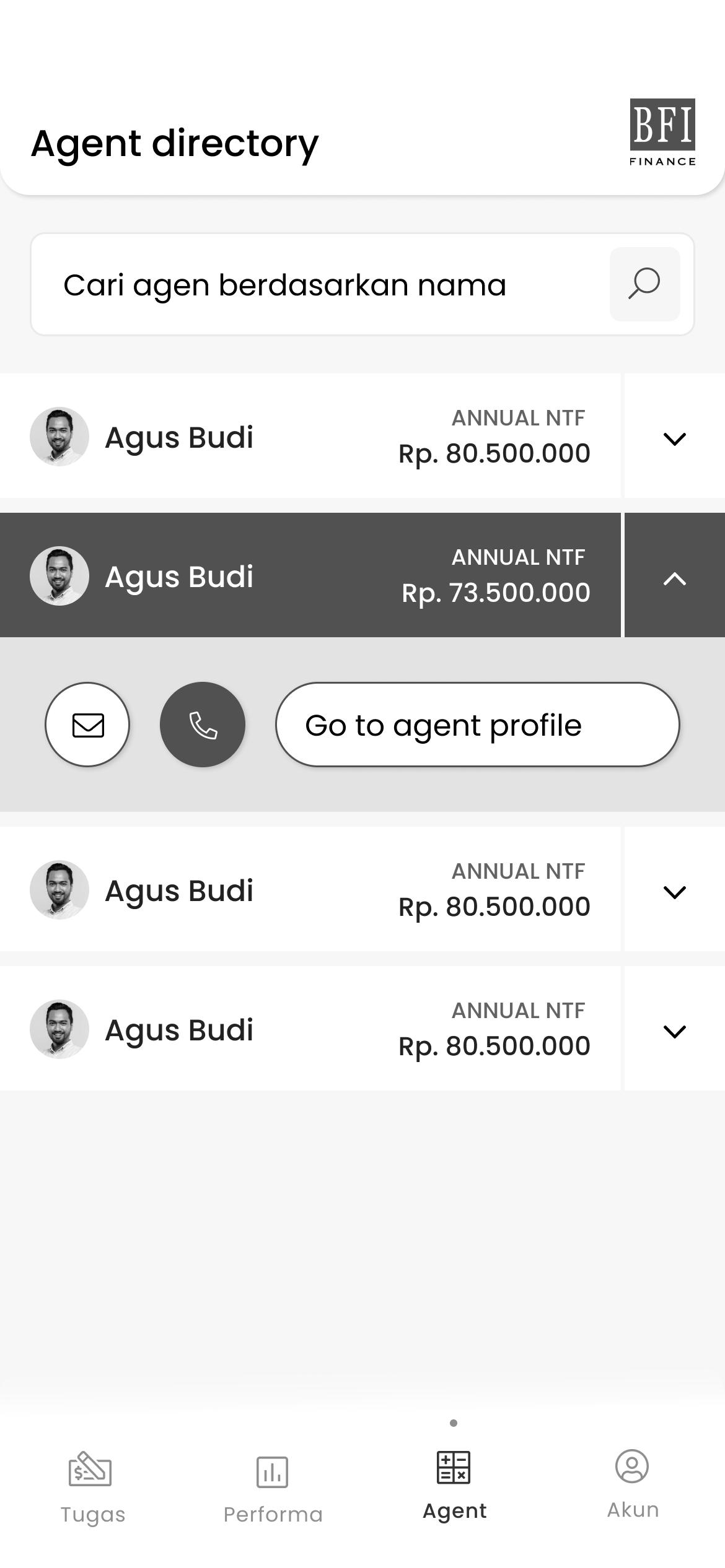

Two connected tools — one for Business Agents in the field, one for the supervisors managing them.

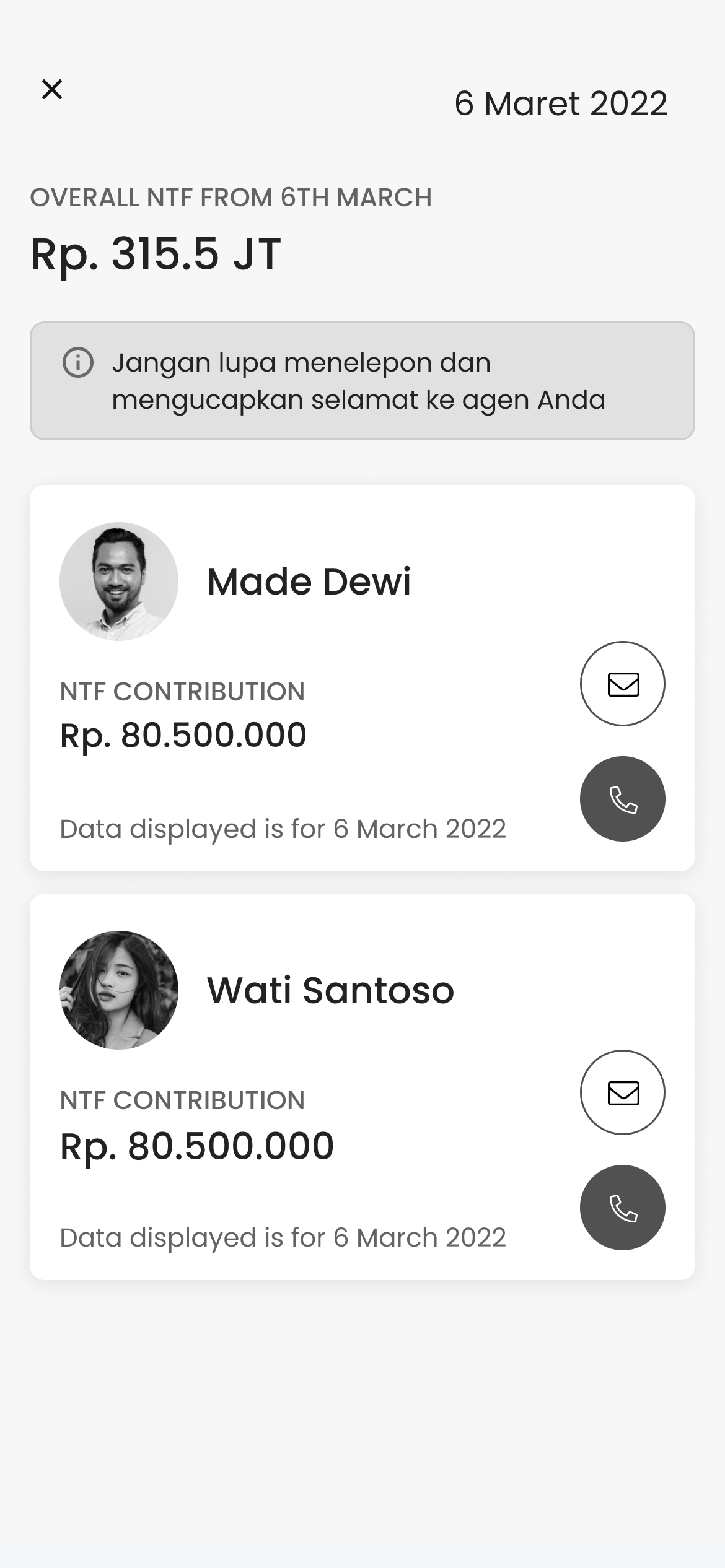

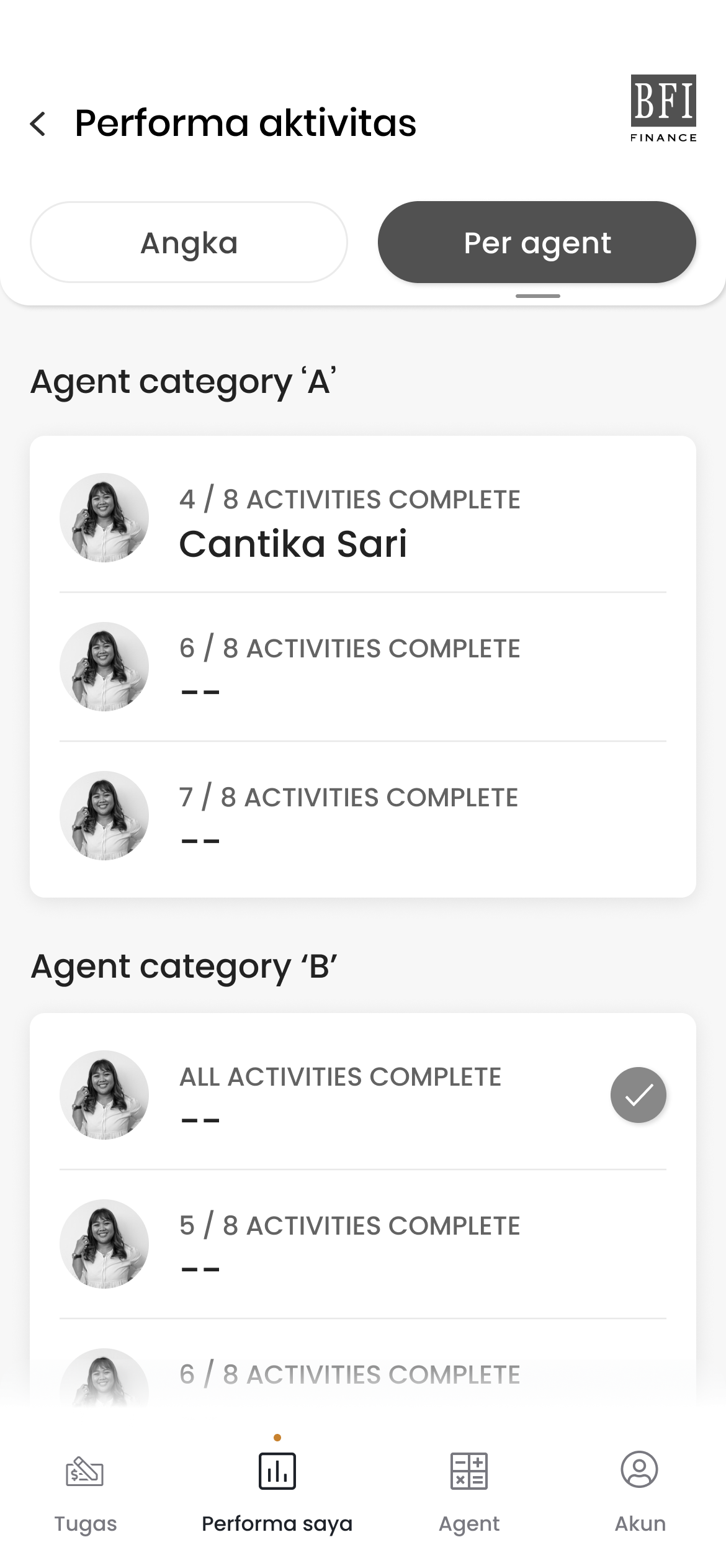

AREs had no way to verify if their Business Agents were completing daily tasks. BAs had no visibility into their own performance or how close they were to commission thresholds. Both problems led to inconsistent output, high turnover, and frustrated management.

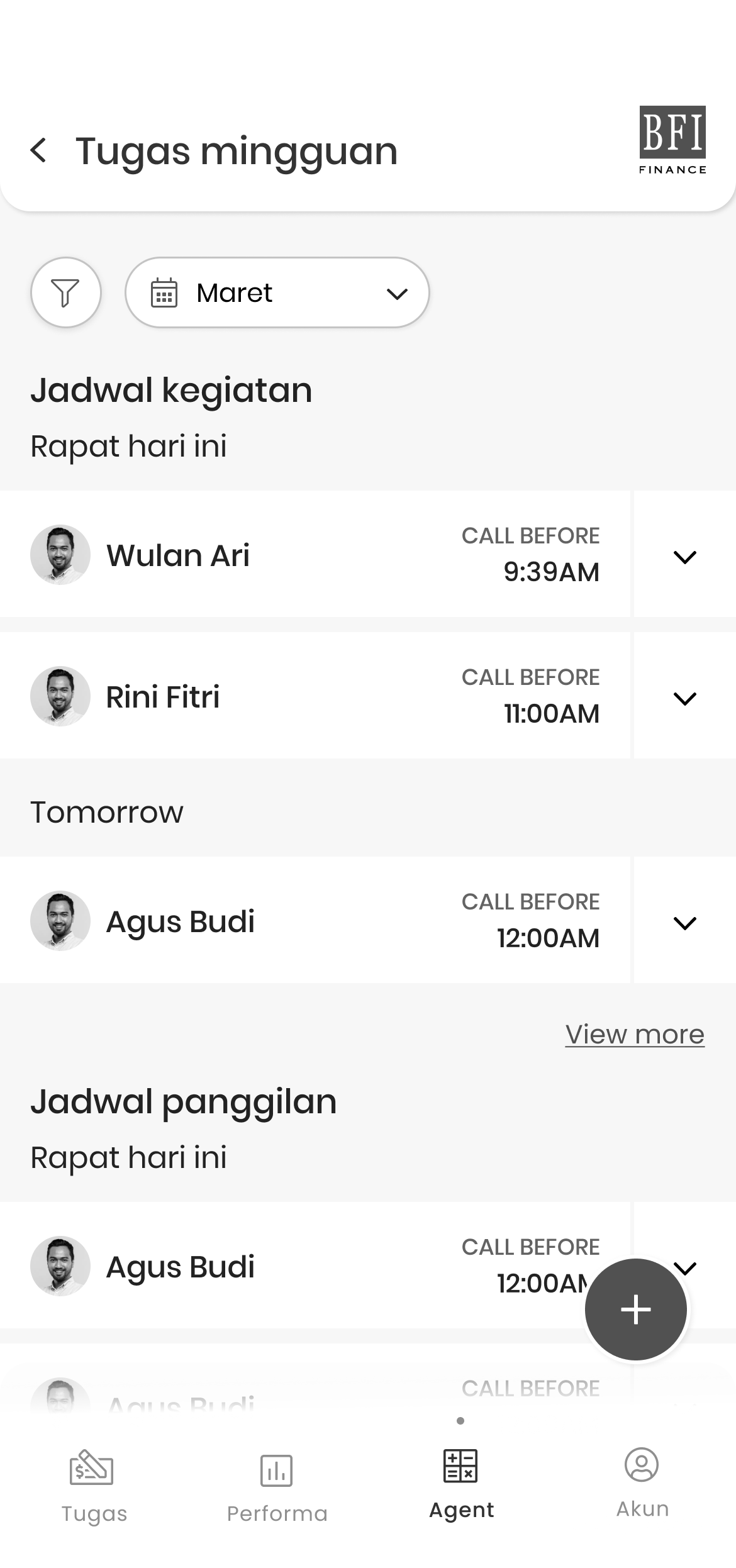

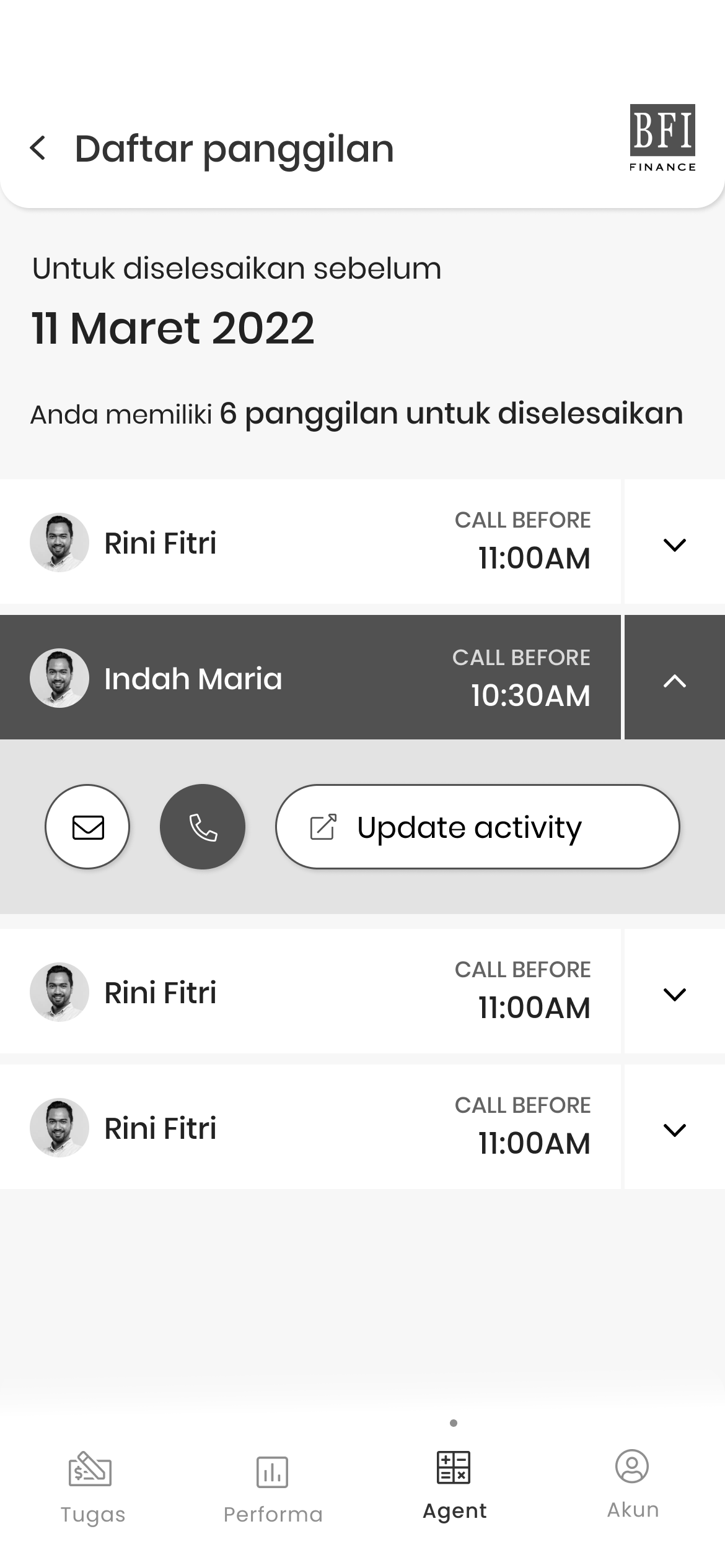

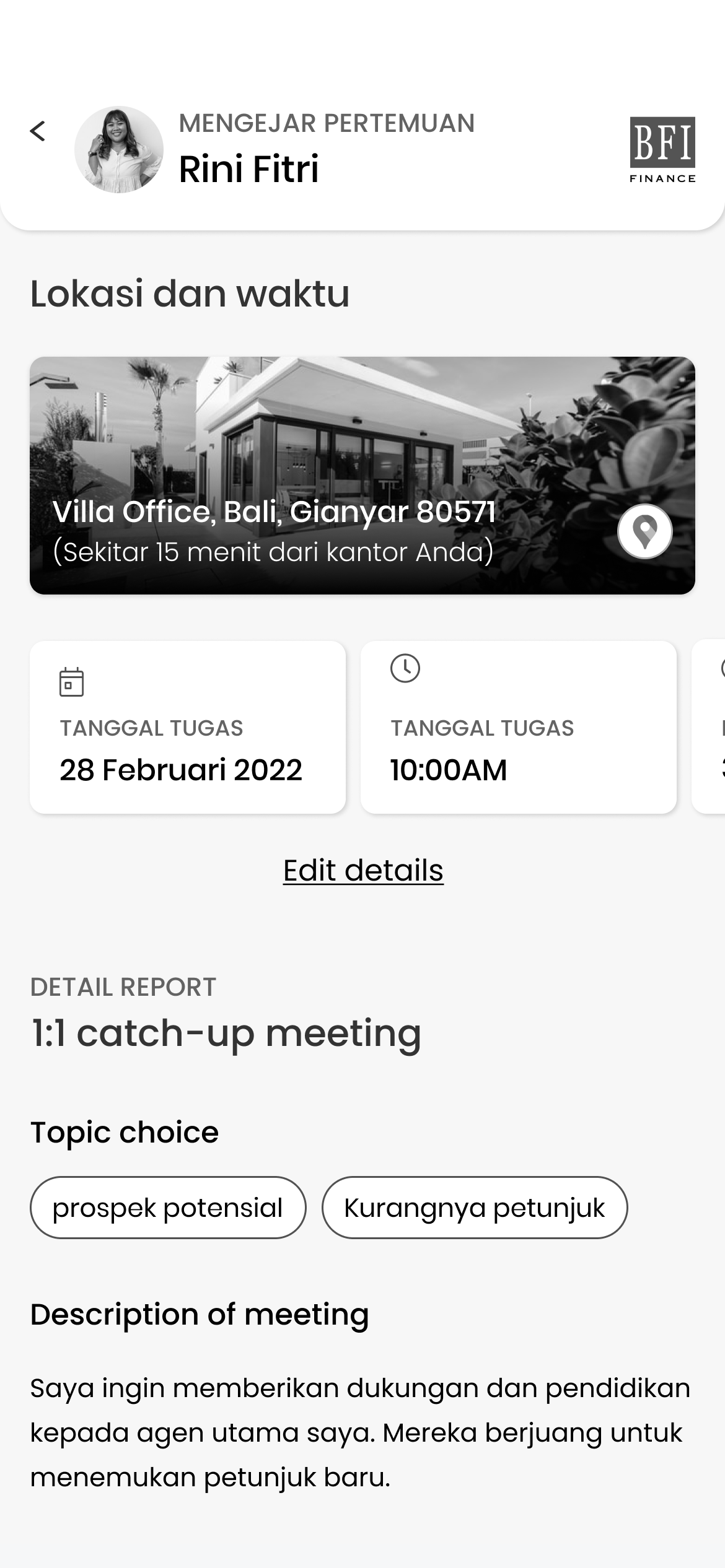

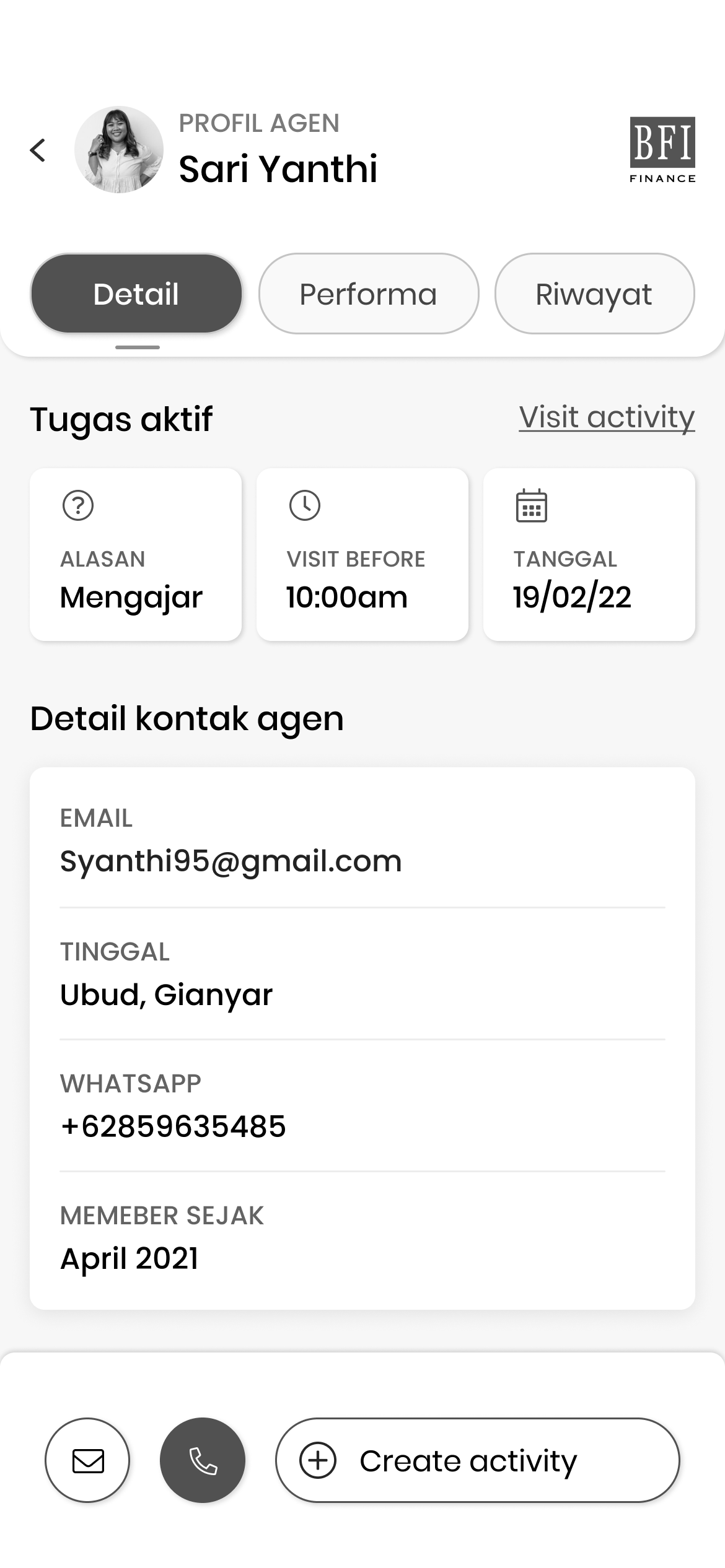

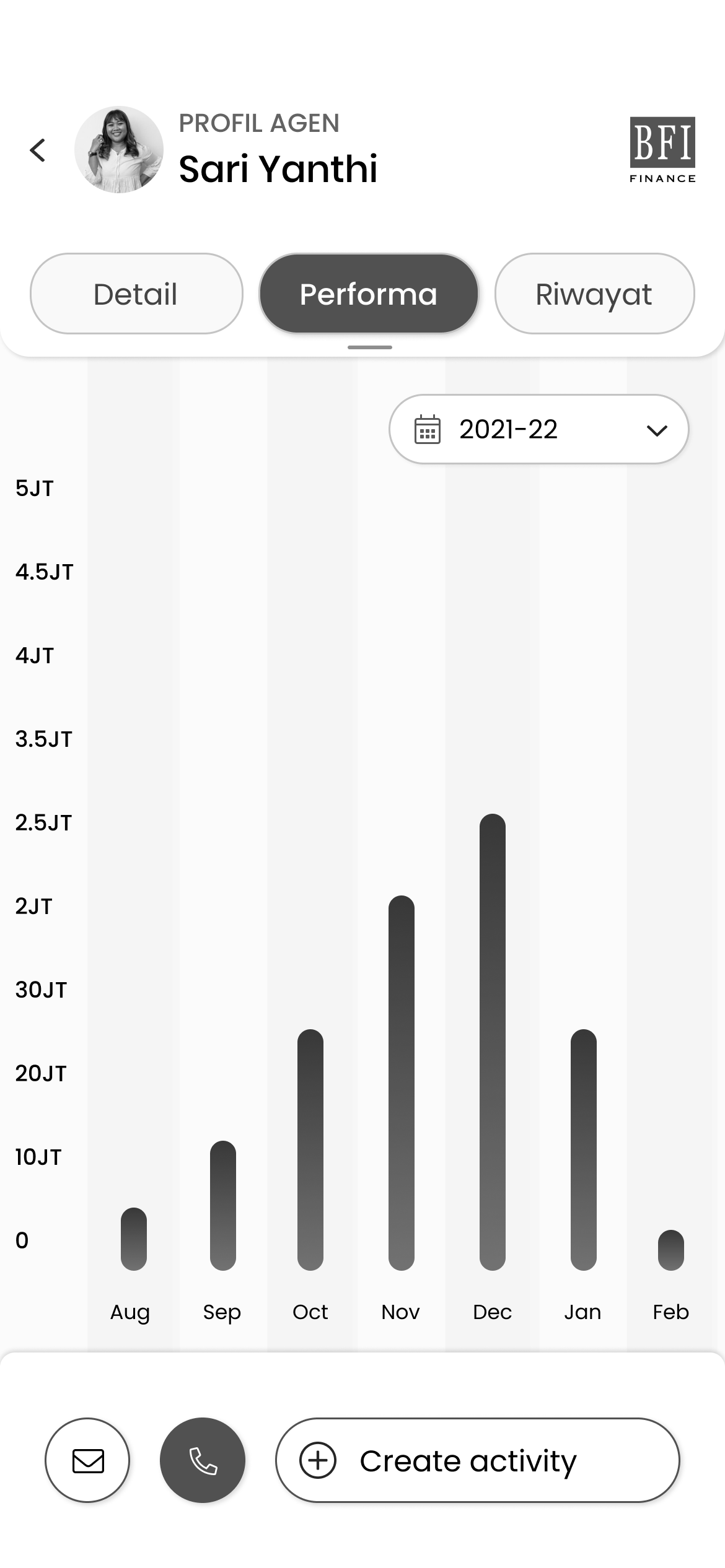

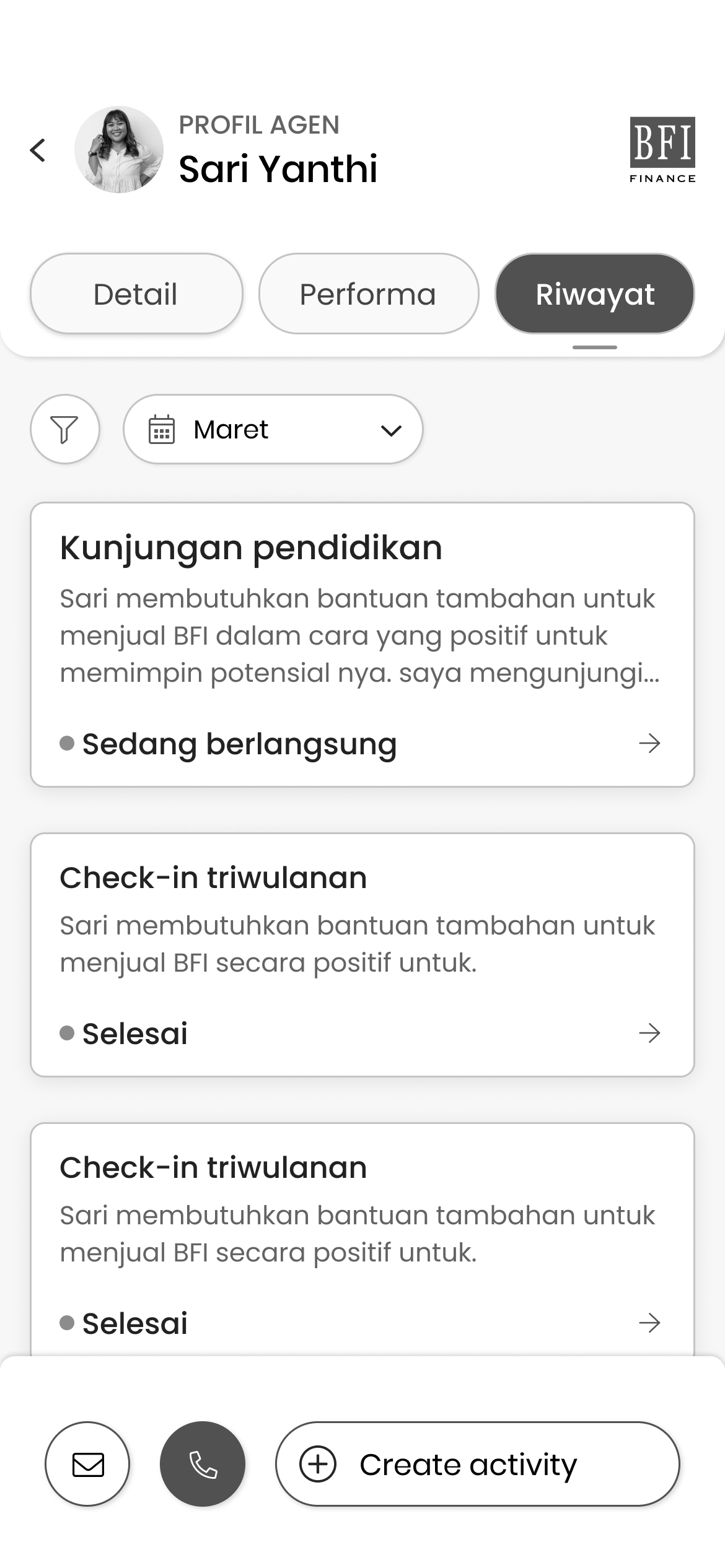

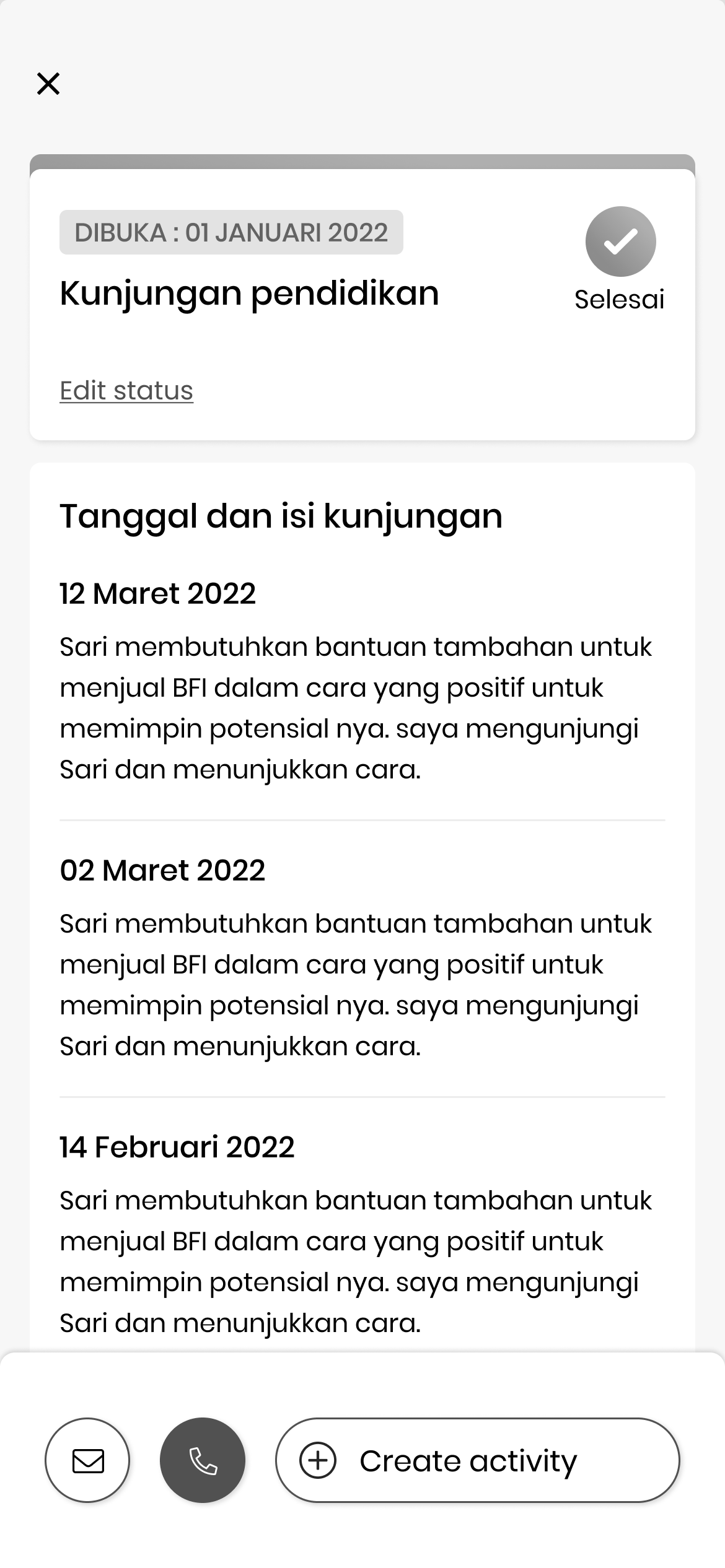

ARE Application

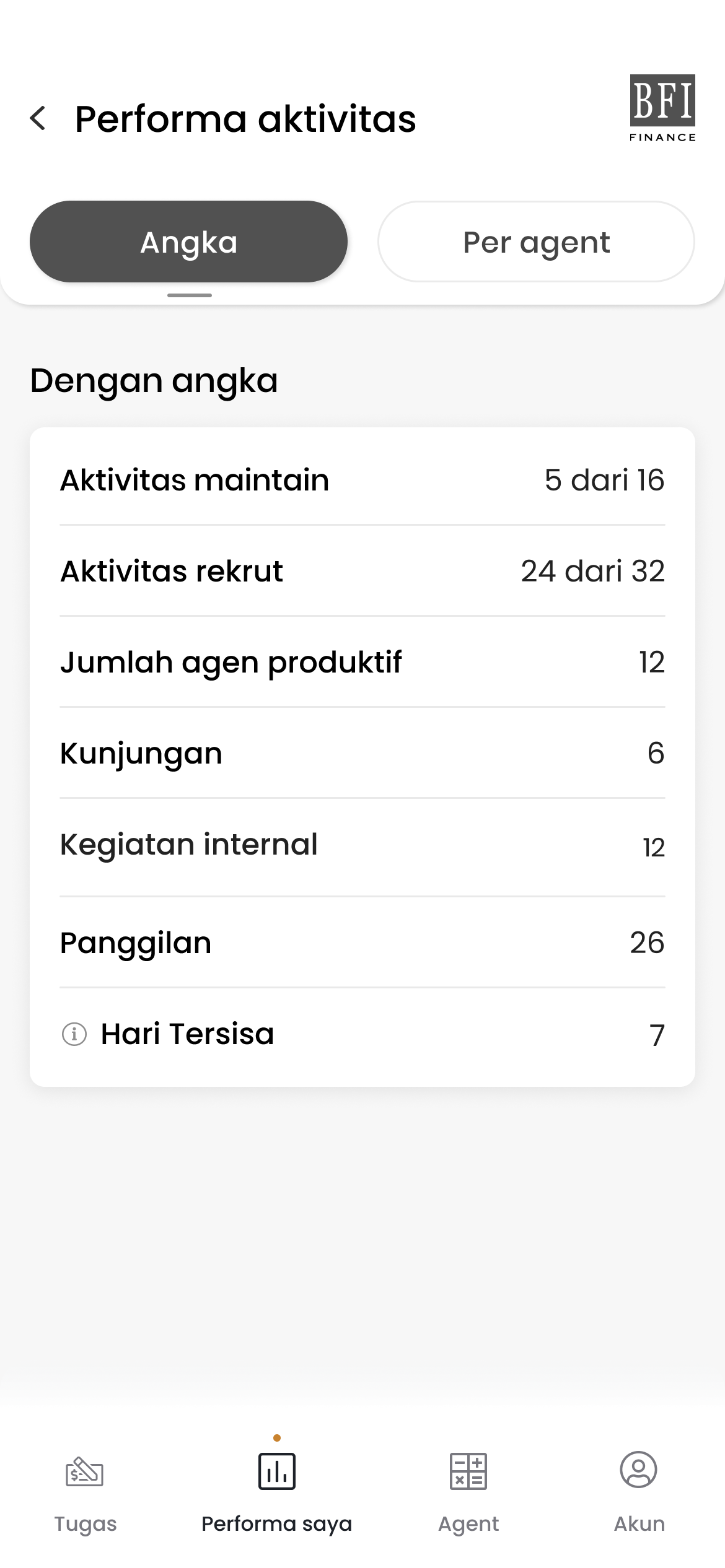

The ARE Application gave supervisors real-time oversight of field operations for the first time. Task completion, meeting attendance, and BA performance — all visible in one place.

Weekly Tasks

Overview of scheduled activities and calls with deadline reminders

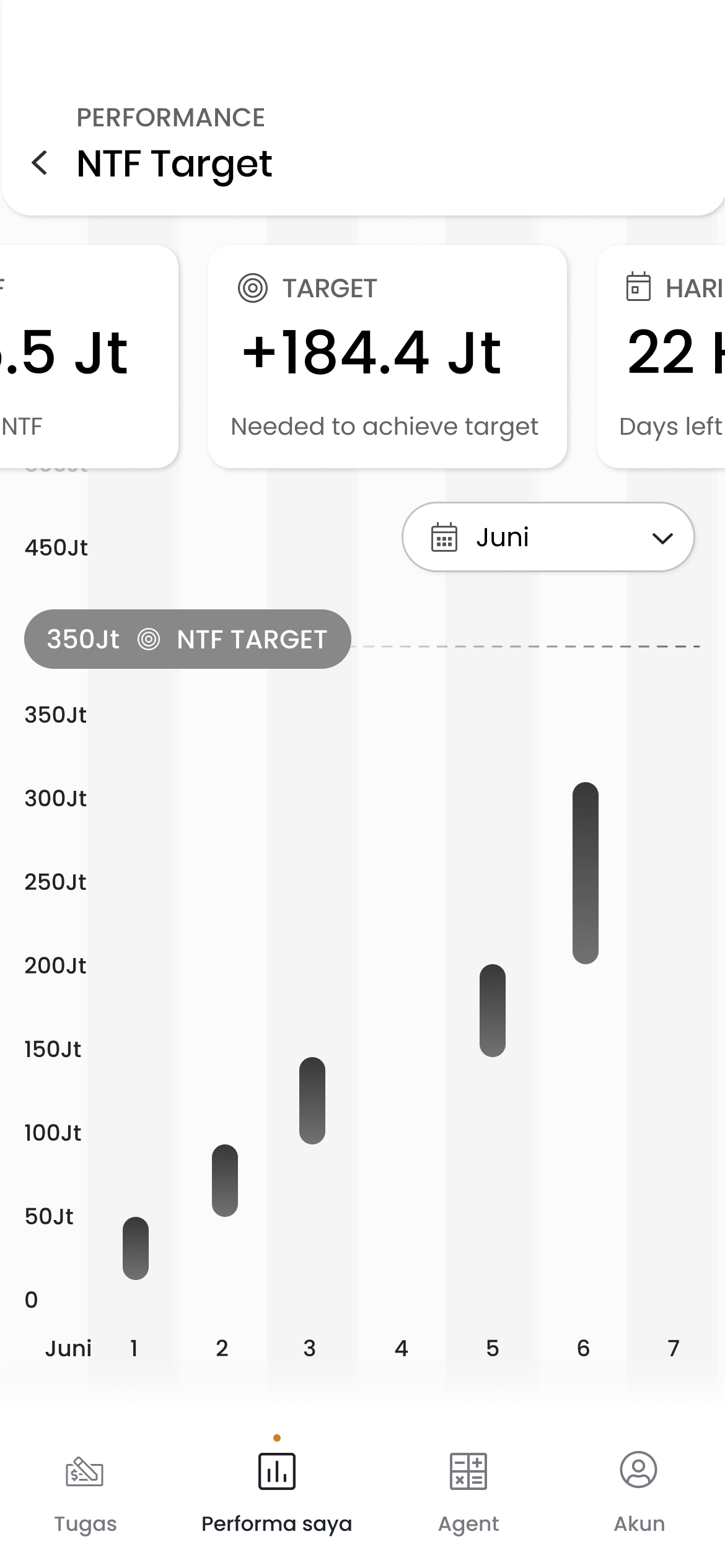

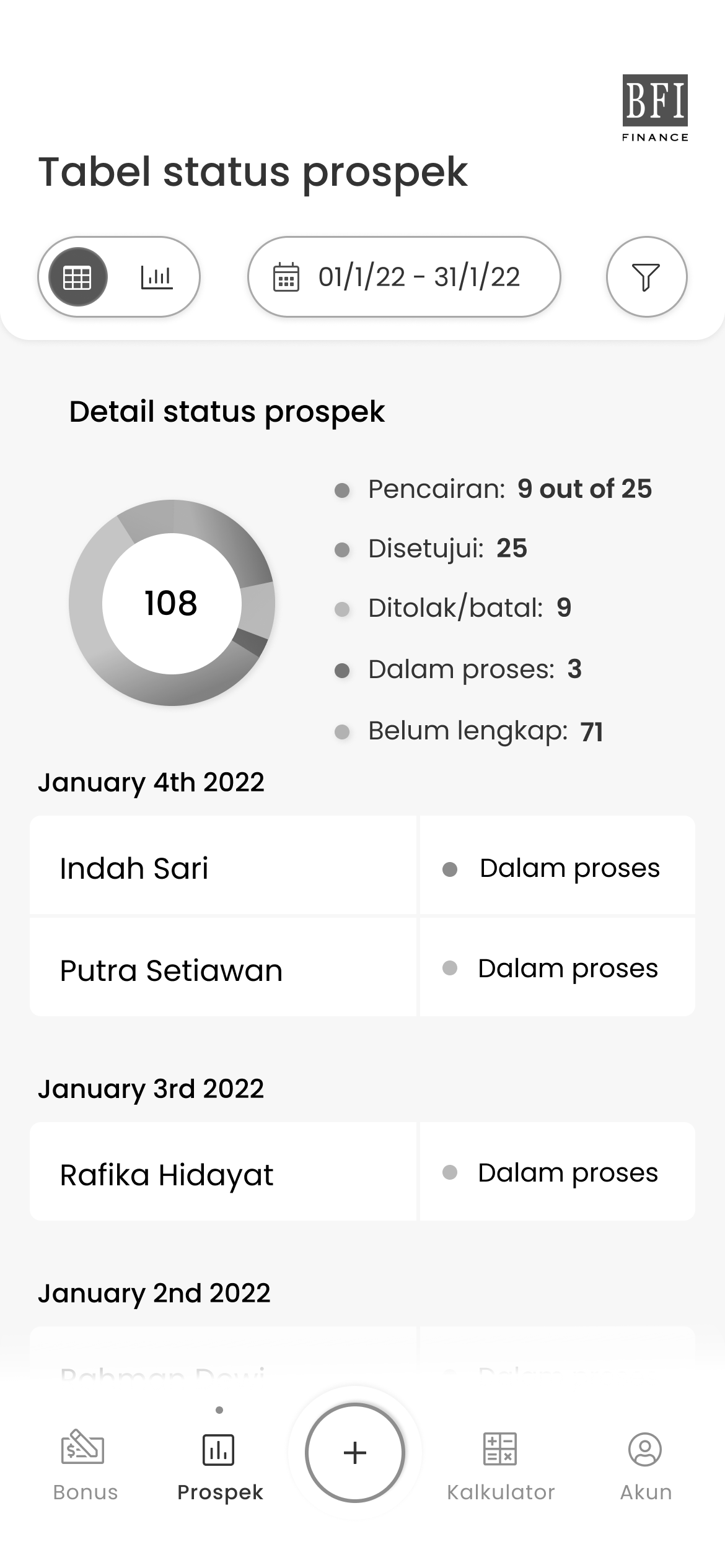

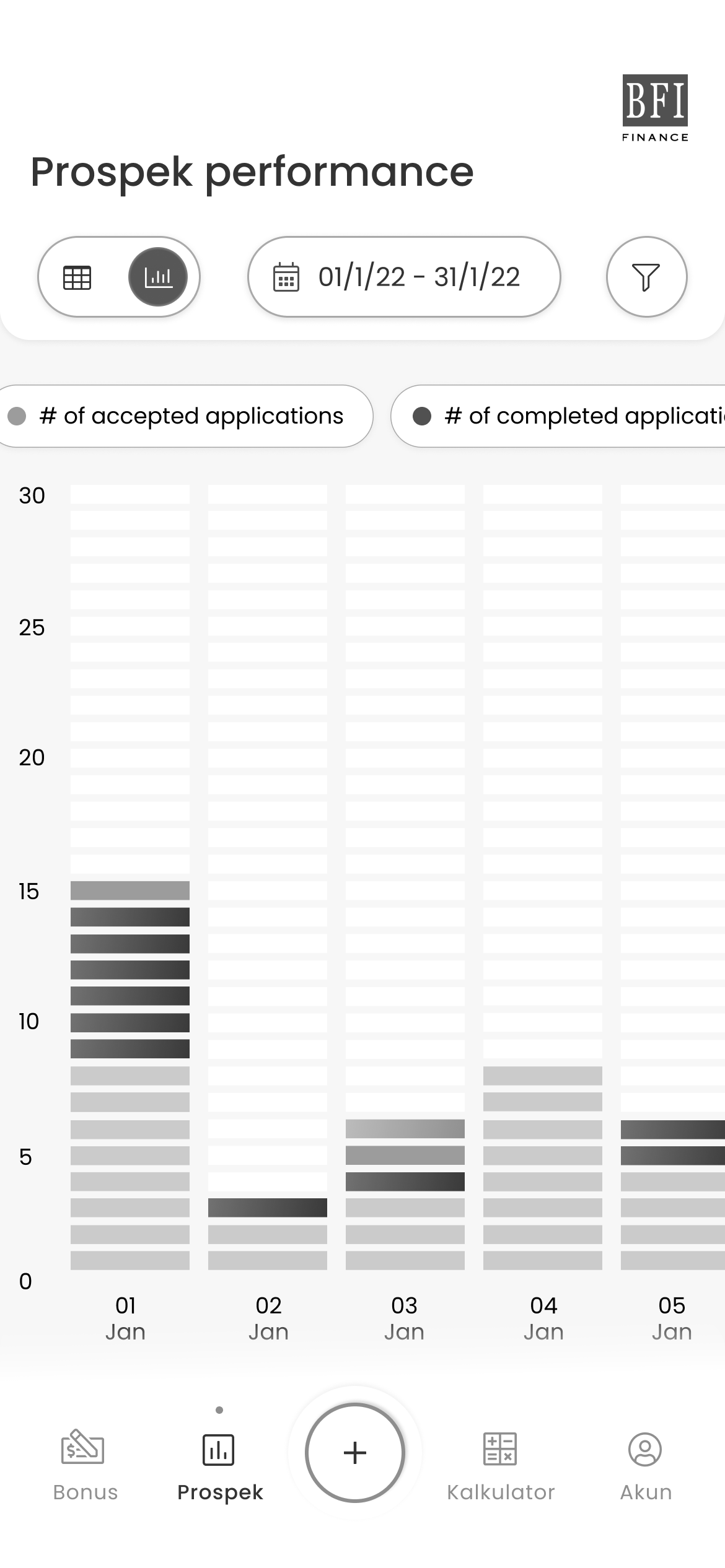

BA Application

The BA Application gave field agents tools they never had — loan calculators, performance tracking, and clear visibility into commission brackets. For the first time, agents could see exactly where they stood and what they needed to hit the next bonus threshold.

We reused 80% of components from previous applications. Key adaptations included commission bracket visualisations, educational tooltips for older agents (average BA age was 42), and self-registration so any Indonesian citizen could sign up as a new BA directly through the app.

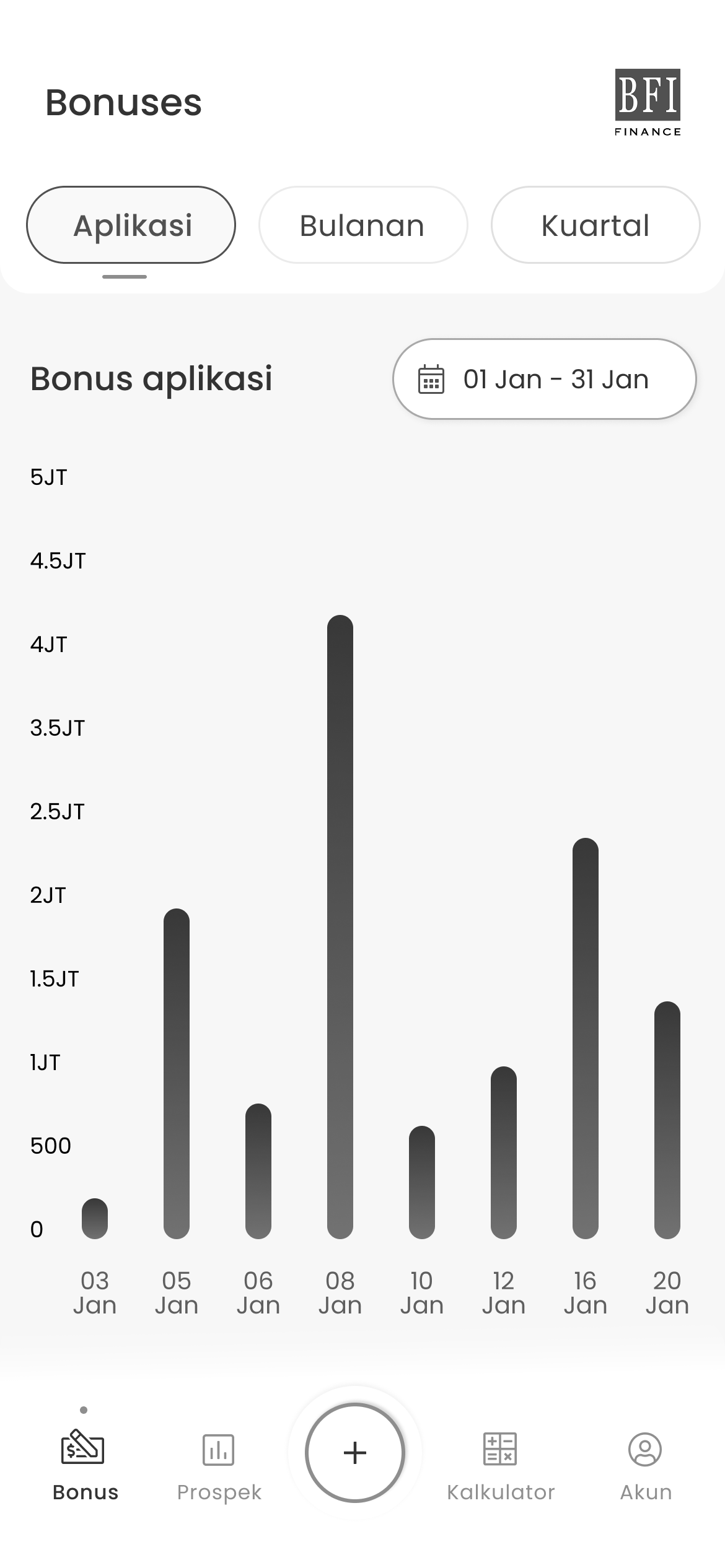

Bonus Dashboard

Daily bonus earnings with interactive chart showing application-based commission details

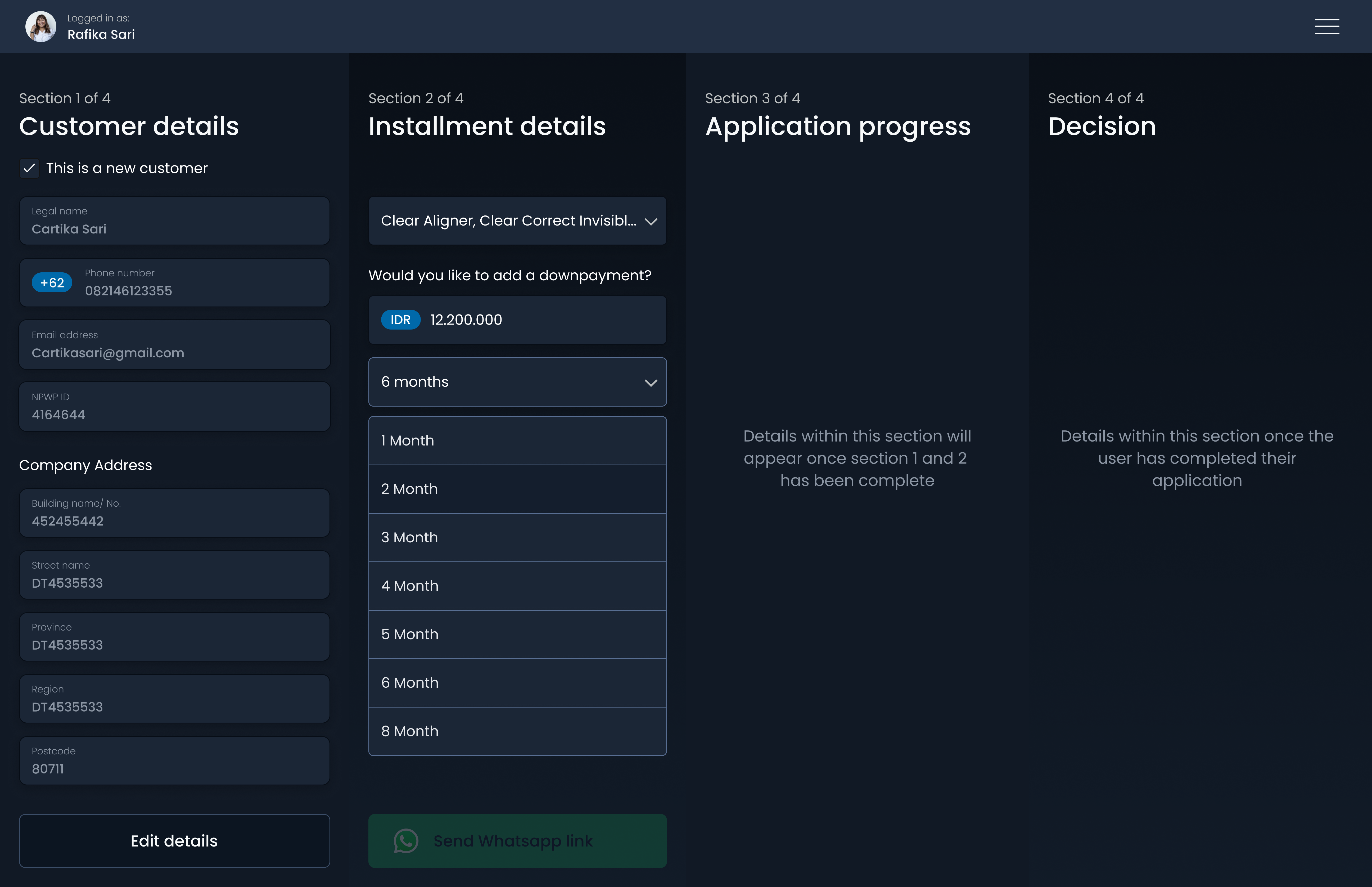

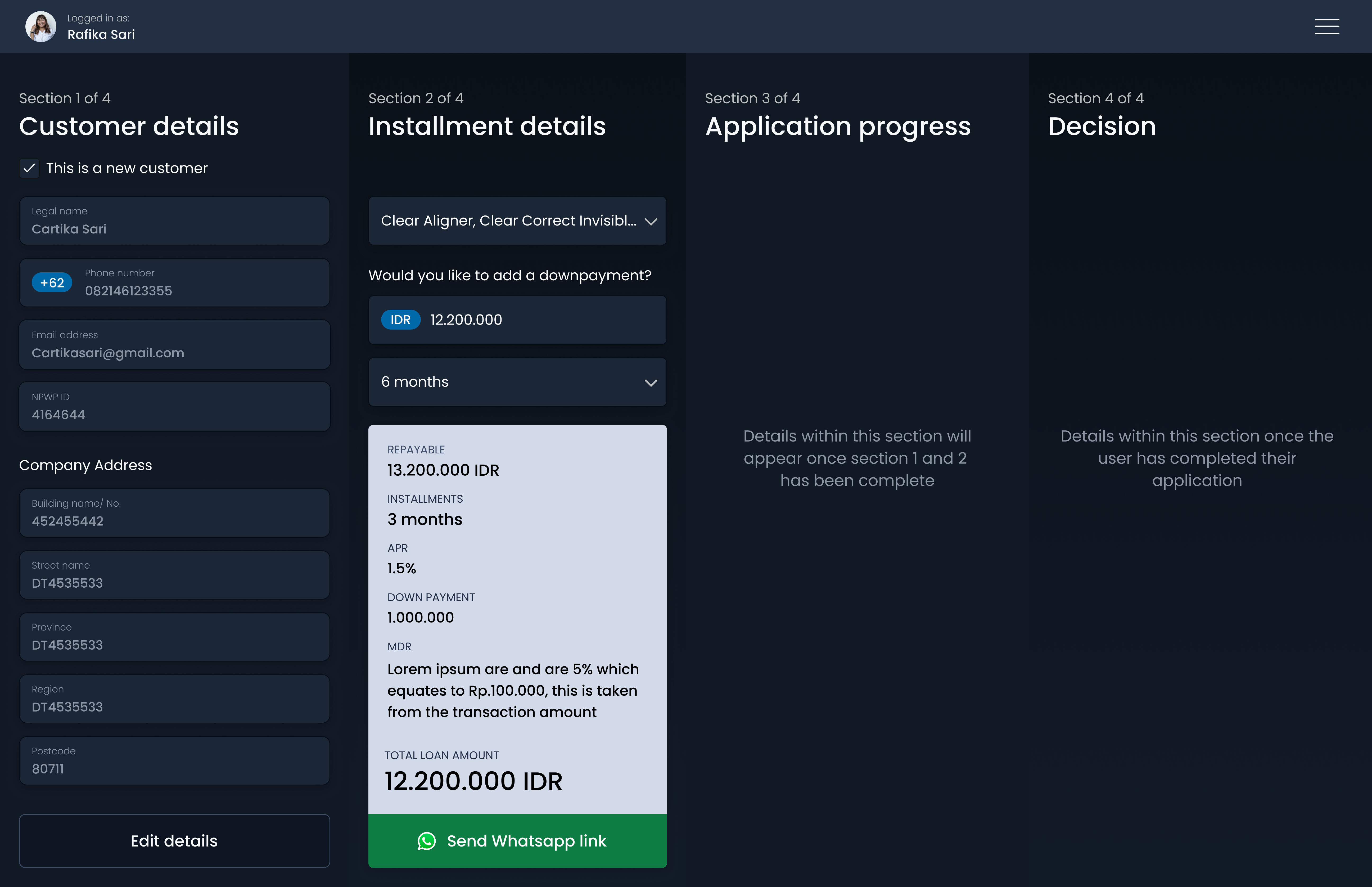

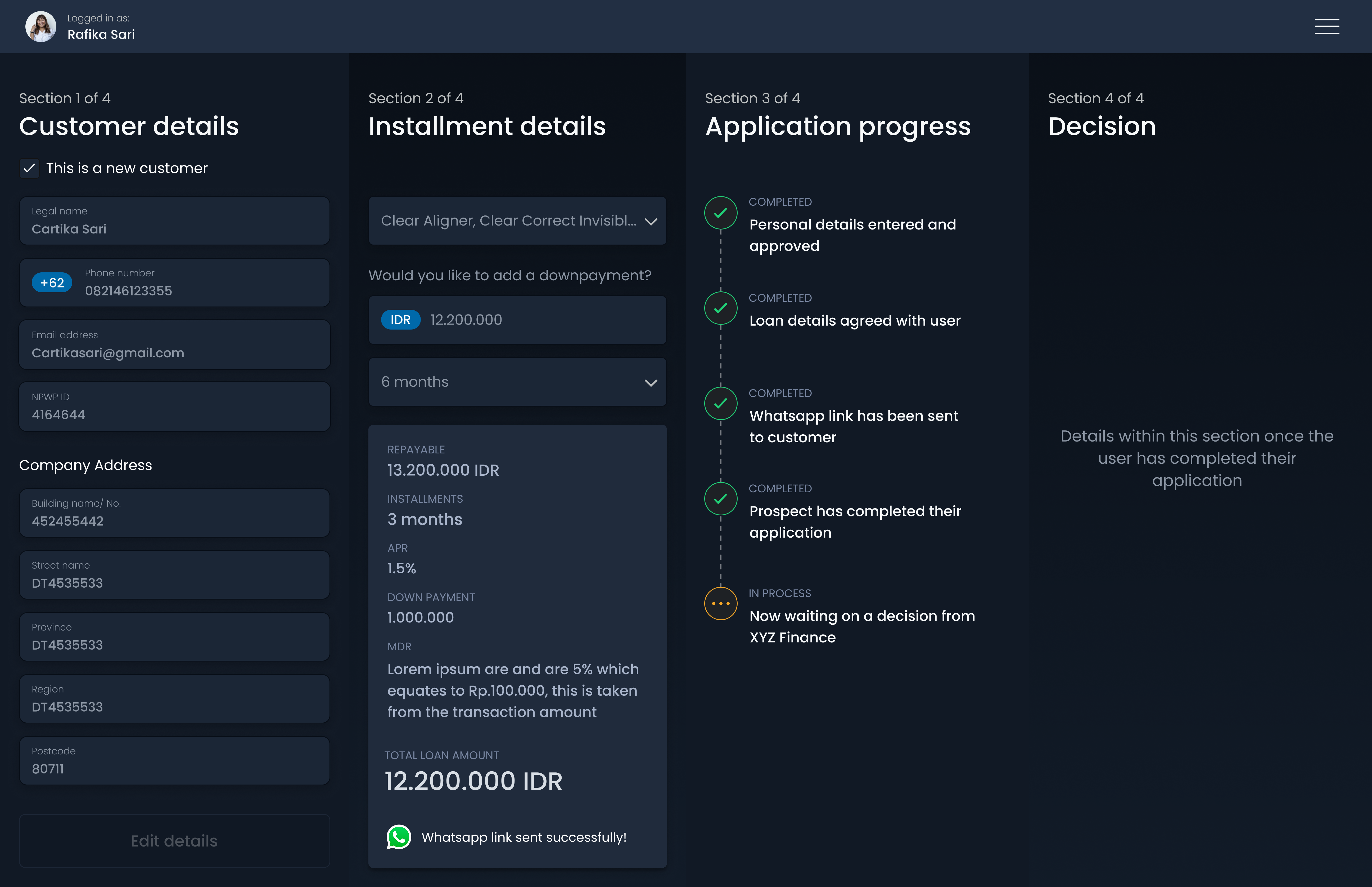

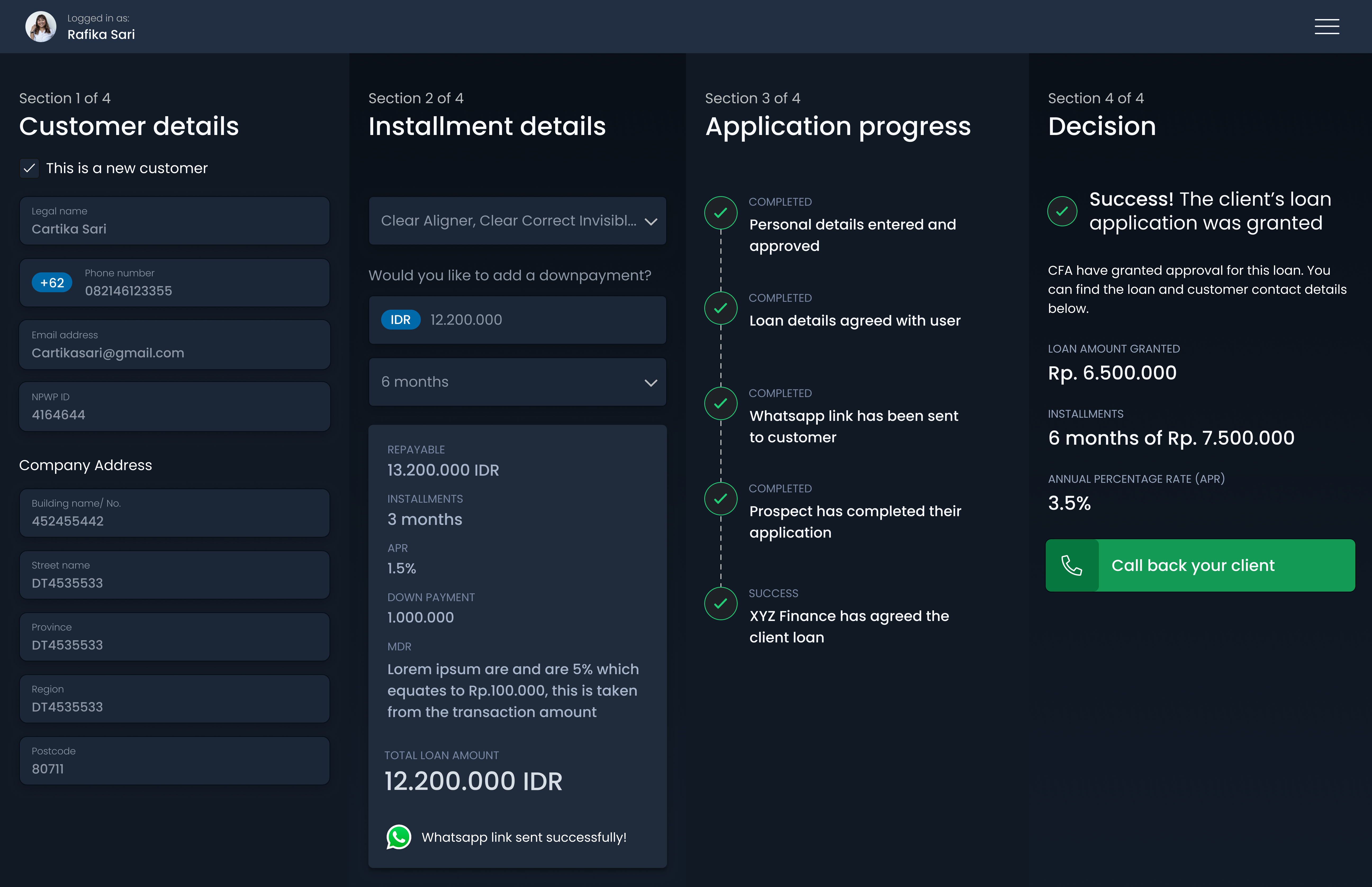

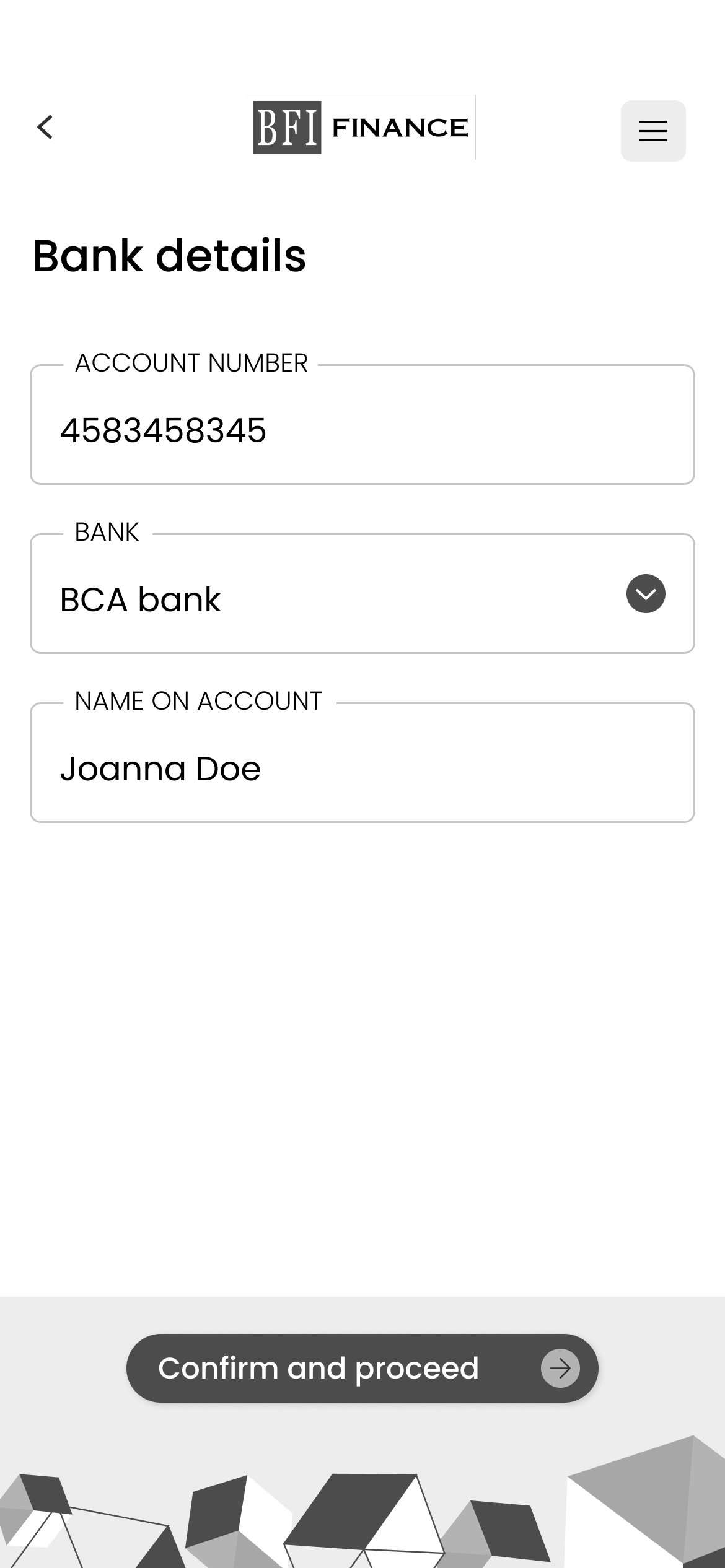

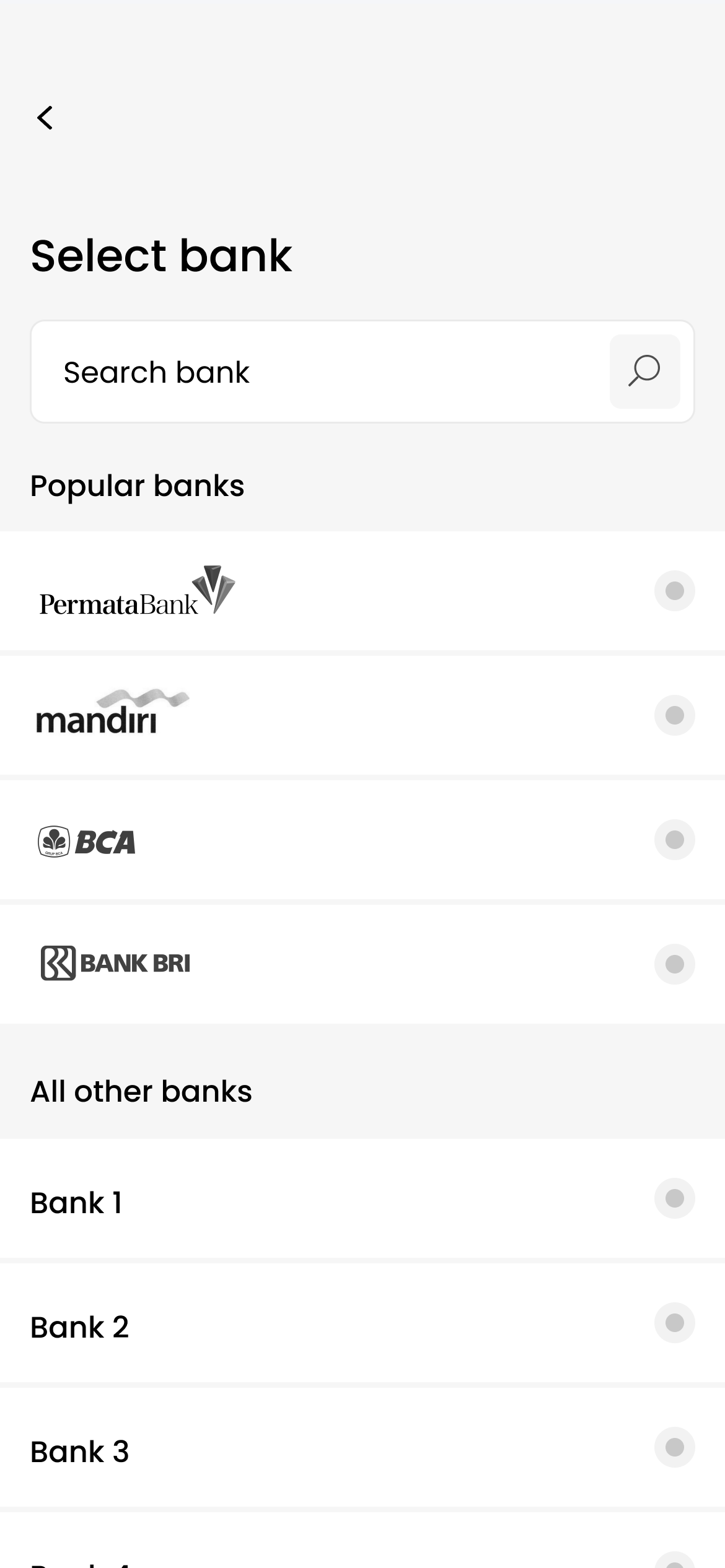

Consumer & Merchant Tool

Bringing financing to the point of sale — so merchants can close deals on the spot.

Merchants had no way to offer instant financing. Customers interested in a purchase had to leave, apply separately, wait for approval, and return — if they returned at all. We built a platform that connects merchants directly to BFI Finance, enabling real-time loan decisions while the customer is still in the store.

Customer Details

Step 1 of 4 — merchant enters customer information with address fields and new customer checkbox

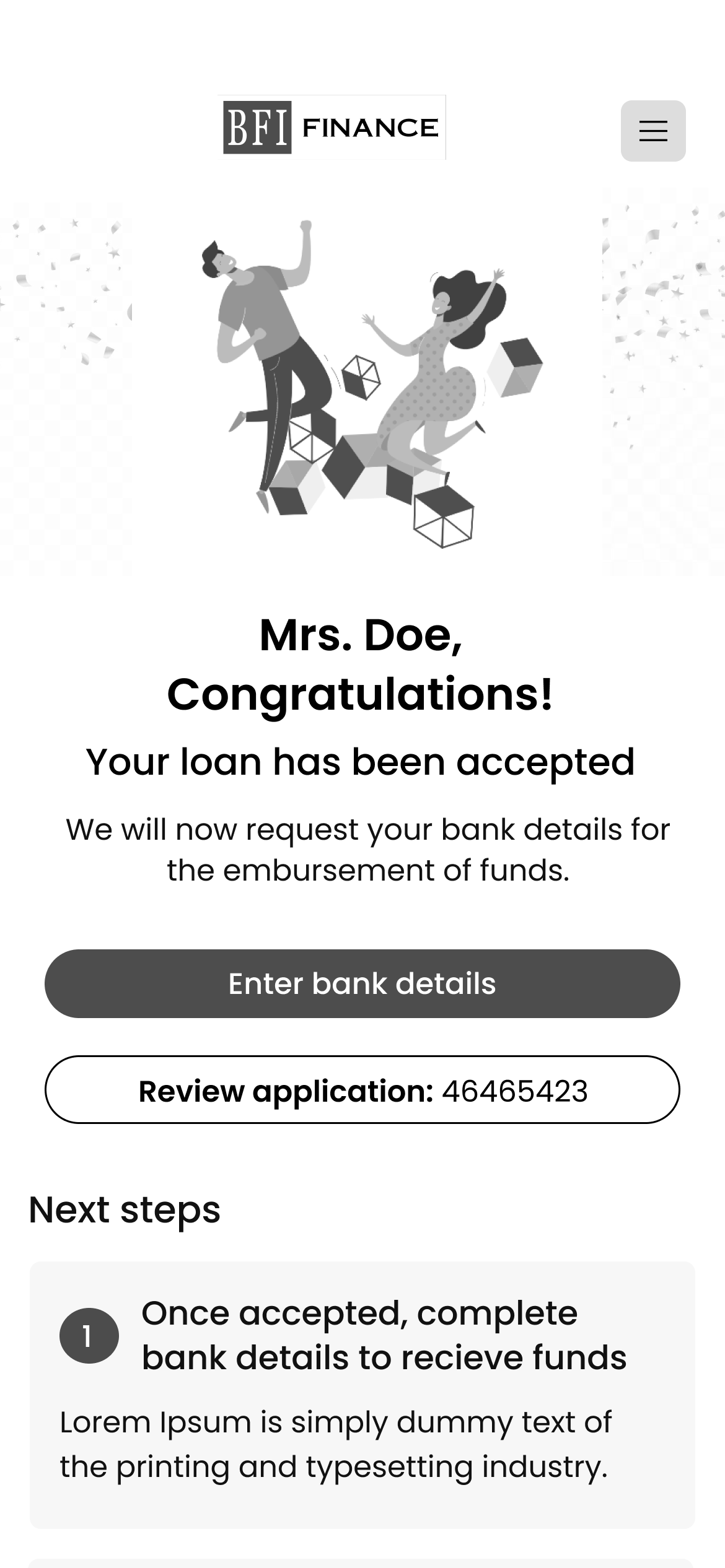

Impact

Since the digital transformation launched in 2021, BFI Finance has seen measurable growth and industry recognition.

Awards

BFI Finance wins Golden Trophy for Best Multi-Finance Company in Digital Brand at the Infobank Brand Recognition Awards 2024.

This recognition reflects the impact of the digital transformation work we delivered — from the consumer loan application to field agent tools and merchant platform. Three consecutive years of industry leadership in digital brand experience.

bfi.co.id/en/news/BFI-Finance-kembali-juara-dalam-infobank-brand-recognition-2024

.png)